Diving deep into the world of home loan pre-qualification, this introduction sets the stage for a captivating exploration of what it takes to get ahead in the home buying game. From understanding the basics to gaining a competitive edge, we’ve got you covered with all the must-know info.

Get ready to navigate the ins and outs of home loan pre-qualification like a pro, and discover how this crucial step can make all the difference when it comes to securing your dream home.

What is Home Loan Pre-Qualification?

When it comes to buying a home, one of the first steps you might take is getting pre-qualified for a home loan. Home loan pre-qualification is an initial assessment by a lender to determine how much you may be able to borrow based on your income, assets, and debts.

Importance of Pre-Qualification

- Helps you understand your budget: Pre-qualification gives you an idea of how much you can afford to spend on a home, making your house hunting process more focused.

- Shows sellers you’re serious: Having a pre-qualification letter can demonstrate to sellers that you are a serious buyer and may give you an edge in a competitive market.

- Saves time: By knowing your budget upfront, you can avoid wasting time looking at homes that are out of your price range.

Differences from Pre-Approval

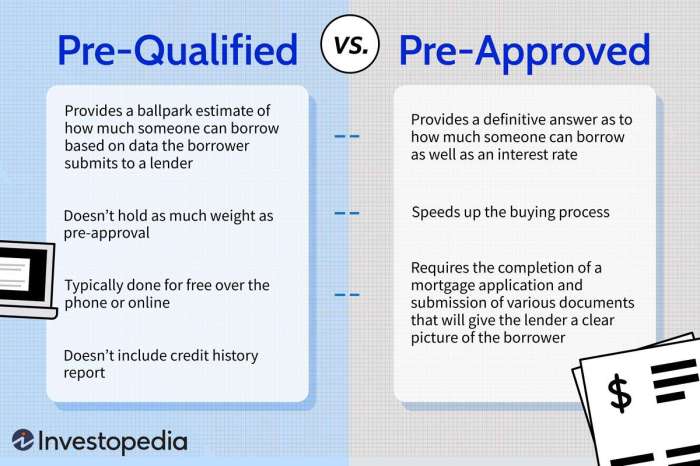

It’s important to note that pre-qualification is not the same as pre-approval for a home loan. While pre-qualification gives you an estimate of how much you can borrow, pre-approval is a more thorough process where the lender verifies your financial information and commits to lending you a specific amount.

Benefits of Home Loan Pre-Qualification

When it comes to the home buying process, getting pre-qualified for a home loan can offer several advantages. Let’s take a look at how pre-qualification can benefit prospective homebuyers and give them a competitive edge in the real estate market.

Streamlined Home Search

- Pre-qualification helps buyers understand their budget and narrow down their search to properties they can afford.

- It saves time by focusing on homes within the buyer’s price range, avoiding wasted efforts on properties outside their financial reach.

Stronger Negotiating Power

- Having a pre-qualification letter shows sellers that the buyer is serious and financially capable of making the purchase.

- Buyers may have an advantage in negotiations, as sellers are more likely to consider offers from pre-qualified buyers over those who have not been pre-qualified.

Quicker Closing Process

- Pre-qualification can expedite the loan approval process once an offer is made, leading to a faster closing timeline.

- It helps reduce the risk of delays or complications during the closing process, providing a smoother home buying experience.

Eligibility Criteria for Home Loan Pre-Qualification

When applying for a home loan pre-qualification, there are specific eligibility criteria that borrowers must meet in order to be considered for approval. Lenders use this process to determine how much you may be able to borrow for a mortgage, based on your financial situation. Let’s dive into the typical requirements and factors that lenders look at during the pre-qualification process.

Typical Requirements for Pre-Qualification

- Proof of income: Lenders will require documents such as pay stubs, W-2 forms, or tax returns to verify your income.

- Credit score: A good credit score is essential for pre-qualification. Most lenders prefer a score of 620 or higher.

- Employment history: Lenders will look at your work history to ensure you have a stable source of income.

- Debt-to-income ratio: This ratio is calculated by dividing your monthly debt payments by your gross monthly income. Lenders typically prefer a DTI ratio of 43% or lower.

What Lenders Look for When Assessing Pre-Qualification Eligibility

- Lenders will assess your ability to repay the loan by analyzing your income and employment stability.

- They will also consider your credit score to evaluate your creditworthiness and determine the interest rate you may qualify for.

- Your debt-to-income ratio plays a crucial role in determining how much you can afford to borrow. A lower DTI ratio indicates less financial strain and a higher chance of loan approval.

How Credit Score, Income, and Debt-to-Income Ratio Play a Role in Pre-Qualification

- A higher credit score can lead to better loan terms, such as lower interest rates and smaller down payments.

- A stable income demonstrates to lenders that you have the financial capacity to make monthly mortgage payments.

- Maintaining a healthy debt-to-income ratio shows lenders that you manage your finances responsibly and can afford a mortgage payment within your budget.

Process of Home Loan Pre-Qualification

When it comes to getting pre-qualified for a home loan, there are specific steps involved in the process. Understanding these steps can help you navigate through the pre-qualification process smoothly.

Steps Involved in the Pre-Qualification Process

- Submit an application: The first step is to fill out an application with a lender. This will include providing information about your income, assets, debts, and credit history.

- Lender review: Once you submit your application, the lender will review your financial information to determine how much you may qualify to borrow.

- Receive pre-qualification letter: If you meet the lender’s criteria, you will receive a pre-qualification letter stating the amount you are pre-qualified to borrow.

Documents Required for Pre-Qualification

- Income verification: Pay stubs, W-2 forms, or tax returns

- Asset verification: Bank statements, investment account statements

- Debt information: Information on outstanding debts like credit card balances, car loans

- Credit history: Authorization for the lender to pull your credit report

Duration of the Pre-Qualification Process

The pre-qualification process typically takes a few days to a week, depending on how quickly you can provide the required documents and how fast the lender can review your application. It’s essential to stay in touch with your lender and promptly provide any additional information they may request to expedite the process.