When it comes to financial decisions, understanding the distinction between secured and unsecured loans is crucial. From the concept of collateral to the impact of credit scores, these loans play a significant role in shaping our borrowing options. Let’s dive into the world of secured vs unsecured loans and unravel the complexities that lie within.

As we explore the nuances of each loan type, we’ll discover the unique features that set them apart and the considerations borrowers need to keep in mind.

Definition of Secured and Unsecured Loans

Secured loans are loans that are backed by collateral, such as a car or a house, which the lender can seize if the borrower fails to repay the loan. On the other hand, unsecured loans do not require any collateral and are based solely on the borrower’s creditworthiness.

Secured Loans

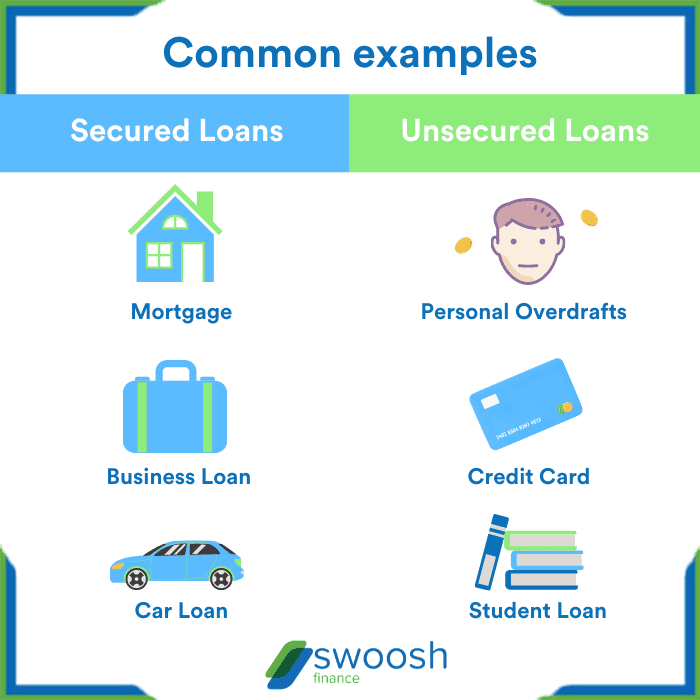

- Examples of secured loans include mortgage loans and auto loans.

- Collateral is an asset that the borrower pledges to the lender to secure the loan.

- If the borrower defaults on a secured loan, the lender has the right to seize the collateral to recoup the loan amount.

Unsecured Loans

- Credit cards and personal loans are common examples of unsecured loans.

- These loans are approved based on the borrower’s credit history and income.

- Since there is no collateral involved, unsecured loans typically have higher interest rates compared to secured loans.

Interest Rates and Risk Factors

When it comes to interest rates and risk factors, secured and unsecured loans have some key differences that borrowers and lenders need to consider.

Interest Rates

- Secured loans typically have lower interest rates compared to unsecured loans. This is because secured loans are backed by collateral, reducing the risk for the lender.

- Unsecured loans, on the other hand, come with higher interest rates since there is no collateral involved. Lenders take on more risk with unsecured loans, which is reflected in the interest rates.

Risk Factors

- For secured loans, the risk factor for lenders is lower since they have the option to seize the collateral if the borrower defaults on the loan. However, borrowers risk losing their assets if they fail to make payments.

- With unsecured loans, lenders face higher risk as there is no collateral to recover in case of default. Borrowers also face the risk of damaging their credit score if they fail to repay the loan.

Credit Scores Impact

- Credit scores play a significant role in determining interest rates for both secured and unsecured loans. Borrowers with higher credit scores are likely to qualify for lower interest rates, as they are considered less risky by lenders.

- On the other hand, borrowers with lower credit scores may have difficulty securing loans or may be subject to higher interest rates to compensate for the increased risk to the lender.

Application Process and Approval Time

When it comes to applying for loans, whether secured or unsecured, the process can vary in terms of documentation required and approval time. Let’s take a closer look at the application process and approval times for both types of loans.

Secured Loans

Secured loans typically require collateral, such as a home or a car, to secure the loan. The application process for secured loans usually involves providing documentation related to the collateral, such as property deeds or vehicle titles. Lenders will also require information about your income, credit history, and employment status to assess your ability to repay the loan.

- Documentation required: Property deeds, vehicle titles, proof of income, credit history, employment verification.

- Approval time: Since secured loans are backed by collateral, the approval process can be quicker compared to unsecured loans. Depending on the lender, approval can take anywhere from a few days to a couple of weeks.

Unsecured Loans

Unsecured loans do not require collateral, but they often have stricter eligibility requirements. The application process for unsecured loans involves providing documentation related to your income, credit history, and employment status. Lenders will evaluate your creditworthiness based on this information.

- Documentation required: Proof of income, credit history, employment verification.

- Approval time: Unsecured loans typically have a longer approval process compared to secured loans, as lenders need to rely more on your creditworthiness. Approval for unsecured loans can take anywhere from a few days to a few weeks.

Accessibility and Loan Amounts

When it comes to accessing loans and the amount you can borrow, secured and unsecured loans have their differences. Let’s break it down for you.

Accessibility

Secured loans are generally more accessible to borrowers with lower credit scores or those who may not meet the strict requirements of unsecured loans. This is because the lender has the security of collateral in case the borrower defaults on the loan.

Loan Amounts

Secured loans typically offer larger loan amounts compared to unsecured loans. Since the lender has the assurance of collateral, they are more willing to lend a higher sum of money to borrowers. On the other hand, unsecured loans usually have lower limits due to the higher risk involved for the lender.

Suitability Scenarios

- If you need a substantial amount of money for a major purchase like a home or a car, a secured loan might be more suitable due to the higher loan limits available.

- On the other hand, if you need a smaller amount for a personal expense or emergency, an unsecured loan could be a quicker and easier option to consider.

- For borrowers with a strong credit history who can qualify for unsecured loans, this option may be more suitable for smaller loan amounts without the need for collateral.