Get ready to dive into the world of retirement account contributions, where financial planning meets tax benefits and everything in between. This topic is all about securing your future in style.

Let’s break down the different types of retirement accounts, contribution limits, and strategies for making the most out of your savings. It’s time to level up your retirement game.

Importance of Retirement Account Contributions

Contributing to a retirement account is crucial for securing your financial future. It allows you to build a nest egg that can support you during your retirement years.

Retirement account contributions play a vital role in financial planning for the future. By consistently saving a portion of your income, you are setting yourself up for a comfortable retirement. This disciplined approach ensures that you have funds available when you no longer have a regular paycheck coming in.

Tax Benefits of Retirement Account Contributions

- Contributions to traditional retirement accounts, like a 401(k) or IRA, are typically tax-deductible. This means that the money you contribute reduces your taxable income for the year, potentially lowering your tax bill.

- Investment earnings within retirement accounts are tax-deferred, allowing your money to grow faster since you don’t have to pay taxes on gains each year. This compounding effect can significantly boost your retirement savings over time.

- Roth retirement accounts, while not offering immediate tax benefits, allow for tax-free withdrawals in retirement. This can be advantageous if you expect to be in a higher tax bracket when you retire.

Types of Retirement Accounts

When it comes to saving for retirement, there are several types of retirement accounts to choose from, each with its own set of features and eligibility criteria.

401(k) Retirement Account

- A 401(k) is an employer-sponsored retirement account where employees can contribute a portion of their pre-tax salary.

- Employers may also match a percentage of the employee’s contributions, up to a certain limit.

- Contributions to a traditional 401(k) are tax-deferred, meaning you don’t pay taxes on the money until you withdraw it in retirement.

Individual Retirement Account (IRA)

- An IRA is a retirement account that individuals can open on their own, regardless of whether they have access to an employer-sponsored plan.

- There are two main types of IRAs: traditional and Roth. Traditional IRAs offer tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement.

- Eligibility criteria for IRAs include income limits and whether you or your spouse have access to a retirement plan at work.

Roth IRA

- A Roth IRA is a retirement account funded with after-tax dollars, meaning contributions are made with money that has already been taxed.

- Unlike traditional IRAs, Roth IRAs allow for tax-free withdrawals in retirement, as long as certain conditions are met.

- Eligibility for a Roth IRA is based on income limits, with contributions phased out for higher-income earners.

Contribution Limits and Rules

When it comes to retirement account contributions, there are specific limits and rules that individuals need to be aware of in order to maximize their savings for the future.

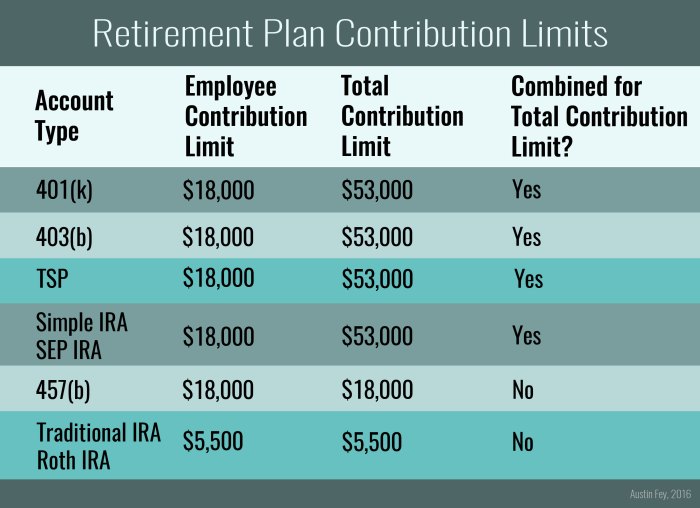

Contribution Limits for Various Retirement Accounts

- For 2021, the contribution limit for 401(k) plans is $19,500 for individuals under 50 years old, with a catch-up contribution limit of an additional $6,500 for those 50 and older.

- For Traditional and Roth IRAs, the contribution limit is $6,000 for individuals under 50, with a catch-up contribution of $1,000 for those 50 and older.

- SEP IRAs have a contribution limit of up to 25% of net self-employment income or $58,000, whichever is less for 2021.

Penalties for Exceeding Contribution Limits

- If an individual exceeds the contribution limits for their retirement account, they may face penalties from the IRS.

- For 401(k) plans, the penalty for over-contributions is 6% of the excess amount per year until corrected.

- For IRAs, the penalty is 6% of the excess contribution amount for each year it remains in the account.

Rules Regarding Contributions to Retirement Accounts

- Contributions to retirement accounts must be made by the tax-filing deadline, usually April 15th of the following year.

- Employer-sponsored retirement plans like 401(k)s may have specific rules regarding when and how contributions can be made, such as through payroll deductions.

- Individuals should be mindful of contribution limits and rules to avoid penalties and make the most of their retirement savings potential.

Strategies for Maximizing Contributions

When it comes to maximizing retirement account contributions, there are several strategies that individuals can employ to ensure they are saving as much as possible for their future financial security.

Benefits of Automatic Contributions and Dollar-Cost Averaging

Automatic contributions are a great way to ensure that you consistently contribute to your retirement account without having to remember to do so manually. By setting up automatic transfers from your paycheck or bank account, you can make sure that you are consistently saving for retirement.

Dollar-cost averaging is another effective strategy for maximizing contributions. This involves investing a fixed amount of money at regular intervals, regardless of market conditions. This helps to reduce the impact of market volatility on your investments and can lead to more consistent returns over time.

Catch-Up Contributions for Individuals Nearing Retirement Age

For individuals who are nearing retirement age and feel like they have not saved enough, catch-up contributions can be a valuable tool. Catch-up contributions allow individuals aged 50 and older to contribute additional funds to their retirement accounts beyond the standard contribution limits. For example, in 2021, individuals aged 50 and older can make catch-up contributions of up to $6,500 to their 401(k) plans on top of the regular contribution limit of $19,500.