Picture this: you’ve got a revolving credit account in one hand and the key to financial freedom in the other. As we delve into the world of managing revolving credit, get ready for a rollercoaster ride of tips, tricks, and insights that will keep you on the edge of your seat.

Now, let’s break down the nitty-gritty details of handling revolving credit like a pro.

Understanding Revolving Credit

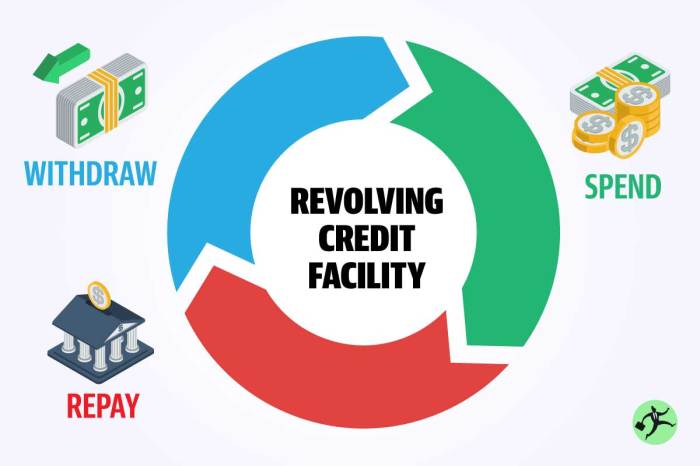

Revolving credit is a type of credit that allows you to borrow funds up to a certain limit and repay the borrowed amount over time. Unlike installment loans where you receive a lump sum and pay it back in fixed installments, revolving credit gives you the flexibility to borrow, repay, and borrow again as needed.

Common Types of Revolving Credit

- Credit Cards: Perhaps the most common form of revolving credit, credit cards allow you to make purchases up to a credit limit set by the issuer. You can pay off the full balance each month or make minimum payments and carry a balance.

- Home Equity Line of Credit (HELOC): This type of revolving credit is secured by the equity in your home. You can borrow against the equity and repay it over time, similar to a credit card.

- Personal Lines of Credit: These are unsecured revolving credit lines that can be used for various purposes, such as emergencies or large expenses. You only pay interest on the amount you borrow.

Benefits and Drawbacks of Revolving Credit

- Benefits:

- Flexibility: You can borrow and repay funds as needed, rather than taking a lump sum upfront.

- Convenience: Easy access to funds through credit cards or lines of credit.

- Build Credit: Responsible use of revolving credit can help improve your credit score over time.

- Drawbacks:

- High Interest Rates: Revolving credit often comes with higher interest rates compared to other types of loans.

- Overspending: Easy access to credit may lead to overspending and accumulation of debt.

- Variable Payments: Monthly payments can fluctuate based on your outstanding balance, making it harder to budget.

How Revolving Credit Works

Revolving credit works by allowing borrowers to continuously borrow money up to a certain credit limit, repay it, and borrow again without needing to reapply for a loan each time.

Interest Calculation

Interest on revolving credit is typically calculated based on the average daily balance of the account. The credit card issuer will apply the daily periodic rate to the average balance to determine the interest charges for the billing cycle.

Repayment Terms

Repayment terms for revolving credit accounts usually require a minimum monthly payment, which is a small percentage of the total balance or a fixed amount, whichever is higher. However, paying only the minimum amount can lead to higher interest charges and a longer repayment period.

Credit Utilization Impact

Credit utilization, which is the ratio of the outstanding balance to the credit limit, plays a crucial role in revolving credit. High credit utilization can negatively impact the credit score as it indicates a higher risk of default. It is recommended to keep credit utilization below 30% to maintain a healthy credit profile.

Managing Revolving Credit

When it comes to managing revolving credit, there are several key strategies to keep in mind. It is crucial to understand the importance of making timely payments on your revolving credit accounts, as well as how to reduce credit card balances and avoid falling into debt traps.

Making Timely Payments

- Set up automatic payments to ensure you never miss a due date.

- Make at least the minimum payment each month to avoid late fees and negative marks on your credit report.

- Consider paying more than the minimum to reduce your balance faster and save on interest charges.

Reducing Credit Card Balances

- Create a budget to track your spending and identify areas where you can cut back.

- Avoid using your credit card for unnecessary purchases to prevent your balance from growing.

- Focus on paying off high-interest credit cards first to save money in the long run.

Avoiding Debt Traps

- Avoid maxing out your credit cards, as this can negatively impact your credit score.

- Be cautious of cash advances, as they often come with high fees and interest rates.

- If you find yourself struggling with debt, consider reaching out to a credit counselor for assistance.

Impact on Credit Score

Revolving credit utilization plays a significant role in determining an individual’s credit score. This percentage represents how much of the available credit is being used, and a high utilization rate can negatively impact the credit score.

Ways to Maintain a Healthy Credit Score

- Keep revolving credit utilization low: Aim to use only a small portion of your available credit to show responsible usage.

- Make timely payments: Paying off the balance in full and on time each month can help maintain a good credit score.

- Avoid opening multiple credit accounts: Opening too many accounts can lower the average age of your credit history, impacting your score.

- Monitor your credit report: Regularly check your credit report for errors and address any issues promptly to avoid negative impacts on your score.

Impact on Creditworthiness

Revolving credit can impact an individual’s creditworthiness by providing lenders with insight into their ability to manage debt responsibly. A high credit score resulting from effective management of revolving credit can increase the likelihood of approval for loans and credit cards with favorable terms.

Using Revolving Credit Responsibly

When it comes to using revolving credit responsibly, there are a few key practices to keep in mind. Responsible use not only helps you build a positive credit history but also ensures you stay on top of your finances.

Budgeting and financial planning play a crucial role in managing revolving credit. By creating a budget and sticking to it, you can avoid overspending and accumulating debt that you may struggle to repay. Financial planning allows you to set financial goals, track your expenses, and make informed decisions about using credit.

Best Practices for Responsible Use of Revolving Credit

- Pay your bills on time: Late payments can negatively impact your credit score and lead to additional fees and interest charges.

- Avoid maxing out your credit limit: Keeping your credit utilization low shows lenders that you can manage credit responsibly.

- Monitor your credit report regularly: Check for any errors or unauthorized charges that could affect your credit score.

Leveraging Revolving Credit for a Positive Credit History

- Make small purchases and pay them off in full each month to show consistent and responsible credit use.

- Diversify your credit mix by having different types of credit accounts, such as credit cards and installment loans.

- Keep old credit accounts open to demonstrate a longer credit history, which can improve your credit score over time.