Diving into the world of financial risk tolerance, we unravel the complexities and nuances of this crucial concept that shapes investment decisions and financial strategies. Get ready to explore the different types, factors influencing, and methods to assess your own risk tolerance in this engaging guide.

What is Financial Risk Tolerance?

Financial risk tolerance refers to an individual’s willingness and ability to withstand fluctuations in the value of their investments. It is essentially the degree of uncertainty that an investor can handle regarding potential losses in their portfolio.

Difference from Risk Aversion

When someone is risk averse, they actively avoid risk and prefer investments with lower returns but higher certainty. On the other hand, financial risk tolerance is more about an individual’s capacity to endure risk and volatility in the pursuit of potentially higher returns.

Factors Influencing Financial Risk Tolerance

- Age: Younger individuals may have a higher risk tolerance as they have more time to recover from potential losses.

- Income: Those with higher incomes may be more tolerant of risk as they have more resources to fall back on.

- Financial Goals: Investors with long-term goals may have a higher risk tolerance compared to those with short-term objectives.

- Knowledge and Experience: Individuals with a deep understanding of investing may be more comfortable with taking on risk.

Types of Financial Risk Tolerance

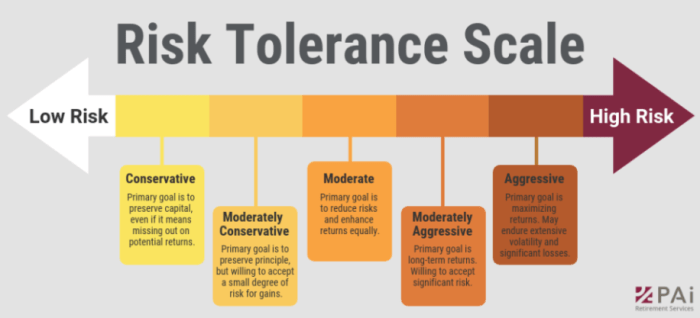

When it comes to financial risk tolerance, individuals can fall into different categories based on their willingness to take on risk in their investments. These categories include aggressive, moderate, and conservative risk tolerance levels. Each type of risk tolerance has a direct impact on the investment decisions individuals make and the strategies they employ.

Aggressive Risk Tolerance

Aggressive investors are willing to take on high levels of risk in exchange for the potential of high returns. These individuals are comfortable with volatility in the market and are willing to invest in high-risk assets such as stocks of emerging companies or speculative ventures. Aggressive investors often have a long-term investment horizon and are looking to maximize their returns over time.

Moderate Risk Tolerance

Moderate investors seek a balance between risk and return. They are willing to accept some degree of risk in their investments but also value stability and consistency. Moderate investors typically have a diversified investment portfolio that includes a mix of stocks, bonds, and other assets. They aim to achieve moderate growth while also preserving capital to some extent.

Conservative Risk Tolerance

Conservative investors prioritize capital preservation and stability over high returns. They are risk-averse and prefer low-risk investments such as government bonds, certificates of deposit, or blue-chip stocks. Conservative investors are more concerned with protecting their principal investment and are less willing to take on significant market fluctuations.

In conclusion, understanding your financial risk tolerance is crucial in determining the appropriate investment strategy for your financial goals. By identifying your risk tolerance level, you can align your investments with your comfort level and financial objectives.

Factors Influencing Financial Risk Tolerance

Understanding the factors that influence financial risk tolerance is crucial in making informed investment decisions. Various aspects such as age, income, wealth, past experiences, and personality traits play a significant role in shaping an individual’s risk tolerance.

Age Influence on Financial Risk Tolerance

Age is a key factor that influences an individual’s financial risk tolerance. Younger investors typically have a higher risk tolerance as they have more time to recover from any potential losses. On the other hand, older investors tend to have a lower risk tolerance as they are closer to retirement and prioritize capital preservation.

Impact of Income and Wealth on Risk Tolerance

Income and wealth levels also impact an individual’s risk tolerance. Those with higher incomes and substantial wealth may be more willing to take on higher risks in pursuit of greater returns. Conversely, individuals with lower incomes or limited wealth may have a lower risk tolerance due to the fear of financial loss.

Past Experiences and Personality Traits in Risk Tolerance

Past experiences and personality traits play a significant role in shaping risk tolerance. Individuals who have experienced significant financial losses in the past may have a lower risk tolerance, while those who have seen success may be more inclined to take on higher risks. Additionally, personality traits such as optimism or pessimism can also influence how individuals perceive and approach financial risks.

Assessing Financial Risk Tolerance

Assessing financial risk tolerance is crucial to ensure that individuals make informed investment decisions that align with their comfort level and financial goals.

Methods Used to Assess Financial Risk Tolerance

- Questionnaires: Financial advisors often use risk tolerance questionnaires to gauge an individual’s comfort level with various investment scenarios.

- Psychometric Testing: Some tools use psychological assessments to determine an individual’s risk attitude and behavior towards financial decisions.

- Professional Guidance: Consulting with a financial advisor can also help assess risk tolerance through in-depth discussions about financial goals and risk preferences.

Role of Risk Assessment Tools

Risk assessment tools play a significant role in determining an individual’s risk tolerance by providing a structured approach to evaluating different risk factors.

These tools help investors understand the potential risks associated with their investment decisions and make informed choices based on their risk tolerance level.

Examples of Crucial Risk Tolerance Assessments

- Retirement Planning: Assessing risk tolerance is essential when creating a retirement plan to ensure that the investment strategy aligns with the individual’s risk profile and financial goals.

- Market Volatility: During periods of market volatility, risk tolerance assessments can help investors stay focused on their long-term objectives and avoid making impulsive decisions.

- Major Life Events: When facing significant life events like buying a home or starting a business, understanding risk tolerance can guide individuals in making sound financial choices.