Let’s dive into the world of emergency fund planning, where financial preparation meets unexpected situations in a dance of security and stability. Discover the secrets to building a safety net that can make all the difference when life throws you a curveball.

Importance of Emergency Fund Planning

Having an emergency fund is crucial for financial stability and security. It acts as a safety net during unexpected situations, providing a sense of preparedness and peace of mind.

Financial Security During Unexpected Situations

Emergency funds can help cover unforeseen expenses such as medical emergencies, car repairs, or sudden job loss. Without a safety net, individuals may be forced to rely on high-interest loans or credit cards, leading to financial strain and debt.

- Emergency funds allow individuals to handle unexpected financial challenges without derailing their long-term financial goals.

- Having a cushion of savings can prevent the need to dip into retirement accounts or other investments during emergencies.

- Emergency funds can provide a sense of financial stability and reduce stress during uncertain times.

Real-Life Examples

During the COVID-19 pandemic, many individuals who had emergency funds were able to cover essential expenses when facing job loss or reduced income.

- A friend of mine was able to cover a major car repair without going into debt because she had an emergency fund set aside for such situations.

- After a sudden illness, a colleague was able to pay for medical expenses without worrying about the financial impact, thanks to her emergency fund.

Determining the Right Amount for an Emergency Fund

When it comes to determining the right amount for an emergency fund, it’s essential to consider your individual circumstances and financial situation. Having an adequate emergency fund can provide you with a safety net in times of unexpected expenses or financial emergencies.

Calculating the Ideal Size of an Emergency Fund

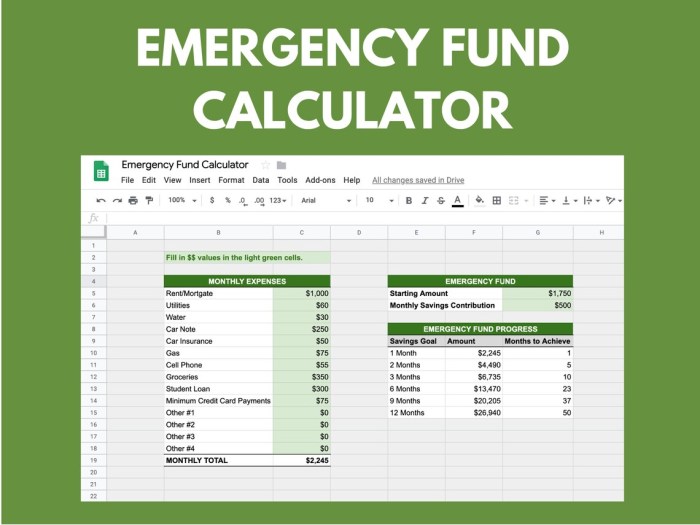

- Start by assessing your monthly expenses: Calculate the total amount you need to cover your essential monthly expenses, including rent, utilities, groceries, and other necessities.

- Consider your income stability: If you have a stable income, you may need a smaller emergency fund compared to someone with irregular income or freelancers.

- Factor in any dependents: If you have dependents, such as children or elderly parents, you may need a larger emergency fund to account for their needs.

- Account for any outstanding debts: It’s crucial to consider any outstanding debts, such as student loans or credit card debt, when determining the size of your emergency fund.

Setting Up an Appropriate Emergency Fund

- Calculate 3 to 6 months’ worth of expenses: Financial experts often recommend saving at least 3 to 6 months’ worth of expenses in your emergency fund.

- Open a separate high-yield savings account: To ensure that your emergency fund is easily accessible when needed, consider opening a separate high-yield savings account specifically for this purpose.

- Automate your savings: Set up automatic transfers from your checking account to your emergency fund savings account to ensure consistent savings every month.

- Regularly review and adjust: Periodically review your emergency fund amount and make adjustments based on any changes in your financial situation or living expenses.

Strategies for Building an Emergency Fund

Building an emergency fund is crucial for financial stability and peace of mind. It provides a safety net for unexpected expenses and emergencies that may arise.

Setting Savings Goals

- Start by determining how much you want to save for your emergency fund. A common rule of thumb is to save three to six months’ worth of living expenses.

- Break down your savings goal into manageable monthly or weekly targets to track your progress.

- Adjust your savings goals as needed based on changes in your financial situation or expenses.

Automating Contributions

- Set up automatic transfers from your checking account to your emergency fund account on a regular basis.

- Automating contributions helps you prioritize saving and ensures that you consistently add to your emergency fund.

- Consider increasing your contributions whenever you receive a raise or windfall to accelerate your savings.

Comparing Savings Vehicles

- Savings Accounts: Offer easy access to funds but may have lower interest rates.

- Certificates of Deposit (CDs): Provide higher interest rates but require you to lock in your money for a specific term.

- Money Market Accounts: Combine the benefits of savings accounts and CDs, offering higher interest rates and some check-writing abilities.

Staying Disciplined

- Create a budget to prioritize saving for your emergency fund and avoid unnecessary expenses.

- Track your spending and identify areas where you can cut back to increase your savings rate.

- Reward yourself for reaching savings milestones to stay motivated and on track with your goals.

Managing and Accessing an Emergency Fund

In times of financial need, having an emergency fund readily available can be a lifesaver. Let’s delve into the importance of keeping this fund accessible and how to effectively manage it.

Keeping Your Emergency Fund Liquid and Easily Accessible

It’s crucial to keep your emergency fund in a liquid form, meaning it can be easily converted to cash without penalties or delays. This ensures you can access the funds immediately when an unexpected expense arises.

Best Practices for Managing an Emergency Fund

- Set clear guidelines for when to use the funds: Determine specific situations that warrant tapping into your emergency fund, such as medical emergencies, car repairs, or sudden job loss.

- Only use the funds for true emergencies: Avoid using the money for non-essential purchases or lifestyle expenses.

- Maintain a separate account: Keep your emergency fund separate from your regular checking or savings account to avoid unintentional spending.

Replenishing Your Emergency Fund

After utilizing your emergency fund, it’s essential to replenish it as soon as possible to ensure you’re prepared for future unexpected expenses. Consider setting up automatic transfers from your paycheck to gradually rebuild the fund over time.