Get ready to dive into the world of payday loans, where cash is king and financial decisions rule the day. Let’s break down the ins and outs of this often misunderstood borrowing option in a way that’s as cool as the other side of the pillow.

In this guide, we’ll explore everything from how payday loans work to the costs involved and even some alternative options that might just save the day. So grab a seat and let’s get started!

What are payday loans?

Payday loans are short-term loans typically used by individuals who need quick cash until their next paycheck. These loans are usually small amounts and come with high interest rates.

How do payday loans work?

When someone takes out a payday loan, they are borrowing money against their future earnings. The borrower typically writes a post-dated check for the amount they are borrowing plus a fee, which the lender will cash on the borrower’s next payday if the loan is not repaid before then.

Typical terms and conditions of payday loans

- High interest rates: Payday loans often come with extremely high interest rates, sometimes reaching triple digits on an annual basis.

- Short repayment period: Borrowers are usually required to repay the loan in full, including fees, by their next payday.

- Loan amount limits: Payday loans are typically for small amounts, usually ranging from $100 to $1000.

Process of applying for a payday loan

To apply for a payday loan, an individual usually needs to provide proof of income, a valid ID, and a post-dated check. The borrower fills out an application form, and if approved, receives the loan amount in cash or deposited directly into their bank account.

Pros and cons of payday loans

When considering payday loans, it’s important to weigh the advantages and disadvantages to make an informed decision about whether this form of borrowing is right for you.

Advantages of payday loans

- Quick access to funds: Payday loans are known for their speedy approval process, providing immediate cash when needed.

- No credit check required: Unlike traditional bank loans, payday lenders typically do not require a credit check, making it easier for individuals with poor credit to qualify.

- Convenience: Payday loans are easily accessible online or in-store, making them a convenient option for emergency expenses.

Disadvantages and risks of payday loans

- High fees and interest rates: Payday loans often come with high fees and interest rates, making them an expensive form of borrowing.

- Debt cycle: Borrowers can easily get trapped in a cycle of debt if they are unable to repay the loan on time, leading to additional fees and charges.

- Impact on credit score: Defaulting on a payday loan can negatively impact your credit score, making it harder to qualify for other forms of credit in the future.

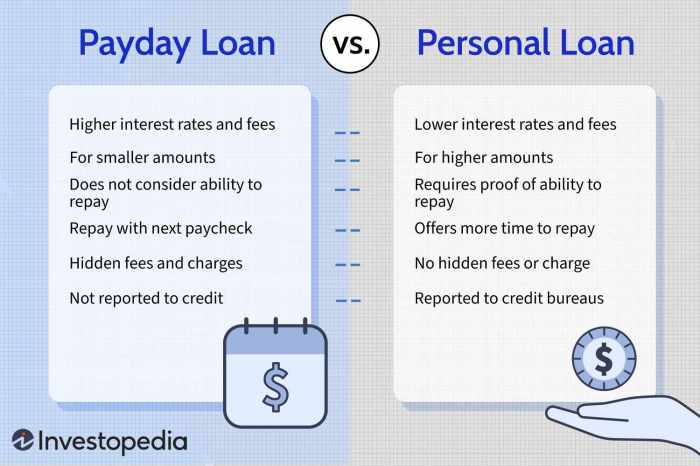

Comparison with traditional bank loans

- Approval process: Payday loans have a quicker approval process compared to traditional bank loans, which may take longer to process.

- Credit check: Traditional bank loans typically require a credit check, while payday loans do not, making them more accessible to individuals with poor credit.

- Interest rates: Traditional bank loans generally have lower interest rates compared to payday loans, making them a more affordable borrowing option in the long run.

Understanding the costs

When it comes to payday loans, it’s crucial to understand the costs involved before taking one out. Let’s break it down for you.

Interest Rates and Fees

- Payday loans typically come with high-interest rates, often exceeding 400% APR.

- In addition to interest, borrowers may also face fees such as origination fees or late payment fees.

How APR Works for Payday Loans

-

APR is the annual percentage rate that represents the total cost of borrowing, including interest and fees, expressed as a yearly percentage.

- For payday loans, the high APR can quickly accumulate significant costs over a short period.

Examples of Cost Accumulation

- For example, taking out a $500 payday loan with a 15% fee and a 400% APR, if you roll over the loan for four months, you could end up paying over $1,000 in total.

- Even small payday loans can quickly become expensive due to the high costs associated with them.

Alternatives to payday loans

When it comes to borrowing money, payday loans are not the only option available. There are several alternatives that individuals can consider to meet their financial needs without getting trapped in the cycle of payday loan debt.

Credit Union Loans

Credit unions offer small-dollar loans with lower interest rates compared to payday loans. These loans are designed to help members in need of financial assistance and often come with more flexible repayment terms.

Personal Installment Loans

Personal installment loans from banks or online lenders can be a better alternative to payday loans. These loans allow borrowers to repay the amount borrowed over a period of time with fixed monthly payments and lower interest rates.

Credit Cards

Using a credit card for emergency expenses can be a more cost-effective option than taking out a payday loan. While credit cards come with high-interest rates, they still tend to be lower than those of payday loans. It is important to make timely payments to avoid accumulating debt.

Emergency Assistance Programs

Many community organizations and non-profit agencies offer emergency assistance programs to help individuals facing financial hardships. These programs provide financial aid, food, housing assistance, and other essential services to those in need.

401(k) Loans

Borrowing from a 401(k) retirement account can be a viable option for those who need quick access to cash. While this option should be considered as a last resort, it can help individuals avoid the high fees and interest rates associated with payday loans.

Family and Friends

Seeking financial help from family or friends can be a better alternative to payday loans. While it may be uncomfortable to ask for assistance, it can save you from the financial burden of payday loan debt.