With tips to improve credit score at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Understanding your credit score is the key to financial success. From knowing what factors impact it to strategies for improvement, this guide has got you covered.

Understanding Credit Score

A credit score is a three-digit number that represents an individual’s creditworthiness based on their credit history. It is calculated using information from credit reports and helps lenders assess the risk of lending money to someone.

Factors Impacting Credit Score

The following factors can impact a credit score:

- Payment History: Timely payments on credit accounts help boost the credit score.

- Credit Utilization: The amount of credit being used compared to the total credit available affects the score.

- Length of Credit History: A longer credit history can positively impact the score.

- New Credit: Opening multiple new credit accounts in a short period can lower the score.

- Credit Mix: Having a mix of different types of credit, such as credit cards and loans, can be beneficial.

Importance of Good Credit Score

A good credit score is crucial for financial health as it can affect one’s ability to qualify for loans, credit cards, and favorable interest rates. It also plays a role in insurance premiums, apartment rentals, and even job opportunities in some cases.

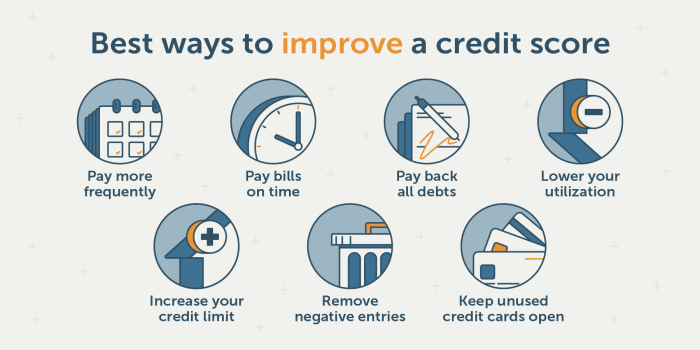

Tips for Improving Credit Score

Improving your credit score is essential for financial stability and access to better opportunities. By following these strategies, you can work towards boosting your credit score and achieving your financial goals.

Pay Bills on Time

One of the most crucial factors affecting your credit score is your payment history. Make sure to pay all your bills on time, including credit card payments, loans, and utilities. Late payments can significantly impact your credit score negatively.

Reduce Credit Card Balances

Another important aspect of improving your credit score is reducing your credit card balances. Aim to keep your credit card balances low relative to your credit limits. High credit card balances can indicate financial strain and negatively impact your credit score.

Check Credit Reports Regularly

Regularly monitoring your credit reports is essential for identifying any errors or fraudulent activity that may be affecting your credit score. By reviewing your credit reports regularly, you can take necessary steps to correct any inaccuracies and improve your credit score.

Diversify Credit Accounts

Diversifying your credit accounts can have a positive impact on your credit score. Having a mix of credit accounts, such as credit cards, loans, and a mortgage, can demonstrate your ability to manage different types of credit responsibly. This diversity can help improve your credit score over time.

Managing Credit Inquiries

When it comes to managing credit inquiries, it’s important to understand the difference between hard and soft credit inquiries. Hard inquiries occur when a lender checks your credit report as part of the decision-making process for a credit application, such as when you apply for a loan or credit card. On the other hand, soft inquiries are usually done for background checks or pre-approved offers and do not impact your credit score.

Impact of Multiple Hard Inquiries

- Having multiple hard inquiries within a short period can negatively impact your credit score as it may indicate to lenders that you are taking on too much debt or are facing financial difficulties.

- Each hard inquiry can lower your credit score by a few points, so it’s essential to be mindful of how often you apply for new credit.

- Hard inquiries remain on your credit report for two years but typically only affect your credit score for the first year.

Tips to Minimize the Impact

- Try to rate shop for loans within a short period (14-45 days) for the same type of credit (e.g., auto loan, mortgage) as credit scoring models typically group multiple inquiries for the same purpose as one.

- Avoid applying for multiple credit cards or loans within a short time frame unless necessary to prevent a significant negative impact on your credit score.

- If you’re rate shopping for different types of credit, such as a mortgage and a car loan, try to space out the applications to minimize the impact of multiple inquiries.

Dealing with Negative Information

When it comes to dealing with negative information on your credit report, it’s crucial to take action to improve your credit score. Whether it’s errors, late payments, or collections, addressing these issues head-on can make a significant impact on your overall credit health.

Addressing Errors on Your Credit Report

If you spot any errors on your credit report, such as inaccuracies in payment history or accounts that don’t belong to you, it’s essential to dispute these errors with the credit bureaus. You can do this by providing documentation to support your claim and requesting an investigation.

Negotiating with Creditors or Collection Agencies

When it comes to late payments or collections, you can try negotiating with creditors or collection agencies to have negative information removed from your credit report. You can propose a pay-for-delete agreement where you pay off the debt in exchange for the removal of negative information. Make sure to get any agreements in writing before making any payments.

Rebuilding Credit After Negative Events

Rebuilding your credit after negative events like bankruptcy or foreclosure may take time, but it’s possible with patience and diligence. Focus on making on-time payments, reducing your credit utilization, and gradually adding positive information to your credit report. Consider applying for a secured credit card or becoming an authorized user on someone else’s account to help establish a positive credit history.