Diving into the world of risk tolerance assessment, we uncover the essential role it plays in financial planning. From shaping investment decisions to guiding asset allocation strategies, understanding risk tolerance is key to achieving financial success.

In this comprehensive guide, we will explore the factors that influence risk tolerance, the methods used to assess it, and how financial advisors interpret the results to drive impactful investment planning.

Importance of Risk Tolerance Assessment

Assessing risk tolerance is a crucial aspect of financial planning as it helps individuals and businesses understand their comfort level with taking risks in their investments. By determining risk tolerance, one can make informed decisions that align with their financial goals and objectives.

Impact on Investment Decisions

- Risk tolerance directly influences the type of investments one should consider. For example, individuals with a high risk tolerance may opt for aggressive investment strategies with potentially higher returns, while those with a low risk tolerance might prefer safer, more conservative options.

- Understanding risk tolerance can prevent individuals from making impulsive investment decisions based on market fluctuations or external factors. It provides a framework for making rational choices that are in line with one’s risk appetite.

Benefits of Risk Tolerance Assessments

- Helps in creating a diversified investment portfolio that balances risk and return, reducing the overall risk exposure.

- Allows individuals to set realistic financial goals based on their risk tolerance, leading to a more sustainable and effective financial plan.

- Enables businesses to make strategic decisions regarding capital allocation, expansion plans, and risk management strategies by understanding their risk appetite.

Factors Influencing Risk Tolerance

When it comes to assessing risk tolerance, there are various personal and external factors that can influence an individual’s comfort level with taking risks in their investments.

Personal Factors Affecting Risk Tolerance

- Personality: Some individuals are naturally more risk-averse, while others may be more comfortable with taking risks.

- Financial Situation: People with stable financial situations may be more willing to take risks compared to those facing financial instability.

- Knowledge and Experience: Individuals with more knowledge and experience in investing may have a higher risk tolerance.

External Factors Influencing Risk Tolerance

- Economic Conditions: The state of the economy can impact how individuals perceive risk and make investment decisions.

- Market Volatility: High volatility in the market can make investors more cautious and lower their risk tolerance.

- Regulatory Environment: Changes in regulations can affect risk perception and influence risk tolerance levels.

Impact of Age, Financial Goals, and Investment Experience

- Age: Younger individuals may have a higher risk tolerance as they have more time to recover from losses, while older individuals nearing retirement may have a lower risk tolerance to protect their savings.

- Financial Goals: The specific financial goals an individual has can determine their risk tolerance, as those with long-term goals may be more willing to take risks for potentially higher returns.

- Investment Experience: Individuals with more investment experience may be more comfortable with risk compared to beginners in the investing world.

Methods for Assessing Risk Tolerance

Assessing risk tolerance is crucial in the financial industry to help investors make informed decisions about their investments. There are various methods used to determine an individual’s risk tolerance, each with its own set of advantages and limitations.

Popular Risk Tolerance Assessment Tools

- Financial Risk Tolerance Questionnaires: These are commonly used tools that ask individuals a series of questions to gauge their willingness and ability to take on financial risk.

- Risk Assessment Software: Some financial institutions use specialized software that analyzes an individual’s financial situation, goals, and preferences to determine their risk tolerance.

Questionnaire-Based Approach to Determining Risk Tolerance

- Questionnaires are designed to assess an individual’s risk tolerance by asking about their investment goals, time horizon, financial situation, and feelings towards risk.

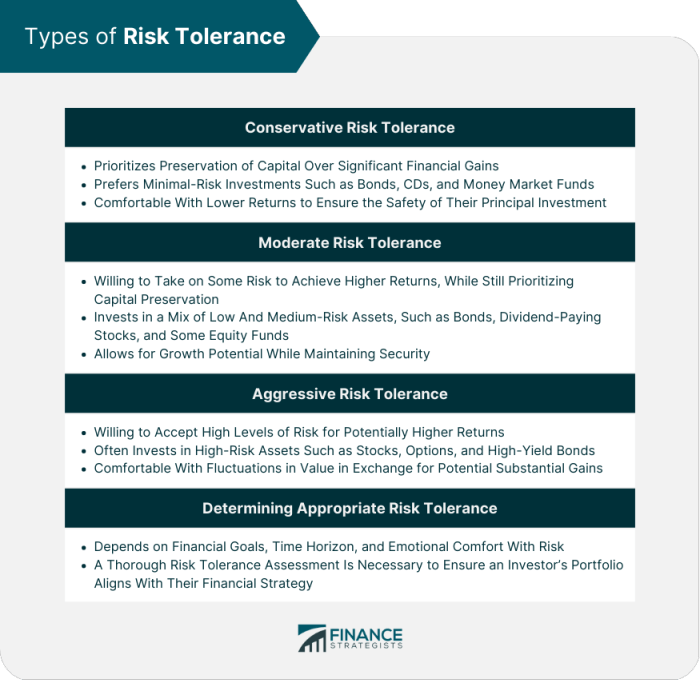

- Responses are then scored to categorize investors into different risk tolerance levels, such as conservative, moderate, or aggressive.

- While questionnaires provide a structured approach, they may not always capture the full complexity of an individual’s risk tolerance.

Comparing Different Methodologies for Evaluating Risk Tolerance

- Some methodologies focus on psychological factors, such as behavioral finance theories, to understand how individuals perceive and react to risk.

- Others rely on quantitative analysis, using statistical models to assess risk tolerance based on factors like age, income, and investment experience.

- Combining multiple methods can provide a more comprehensive view of an individual’s risk tolerance, helping to create a well-rounded investment strategy.

Interpreting Risk Tolerance Results

When financial advisors receive the results of a risk tolerance assessment, they carefully analyze the scores to understand their clients’ willingness and ability to take on investment risk. These scores play a crucial role in shaping the investment planning process and determining suitable strategies for asset allocation.

Significance of Risk Tolerance Scores in Investment Planning

Risk tolerance scores provide valuable insights into how comfortable an individual is with taking risks in their investment portfolio. This information helps financial advisors tailor investment recommendations that align with their clients’ risk preferences, financial goals, and time horizon. By understanding a client’s risk tolerance, advisors can create a diversified portfolio that balances risk and potential returns effectively.

Examples of How Risk Tolerance Results Influence Asset Allocation Strategies

- For clients with a high risk tolerance score, financial advisors may recommend a more aggressive investment approach, with a higher allocation to equities and alternative investments. These clients are more willing to accept fluctuations in their portfolio value in exchange for the potential for higher returns.

- On the other hand, clients with a low risk tolerance score may be advised to follow a conservative investment strategy, focusing on fixed-income securities and lower-risk assets. This helps protect their capital and minimizes the impact of market volatility on their portfolio.

- For clients with a moderate risk tolerance score, a balanced approach to asset allocation is usually recommended. This involves a mix of stocks, bonds, and cash equivalents to provide a reasonable level of growth potential while managing risk exposure.