Get ready to dive into the world of income tax on investments. It’s like navigating the hallways of high school, but instead of lockers, we’re unlocking the secrets of how investments are taxed. So grab your backpack and let’s explore this topic together.

In this guide, we’ll break down what income tax on investments is all about, from the types of investments that are taxed to how deductions and credits can play a role in reducing your tax bill.

Overview of Income Tax on Investments

Income tax on investments refers to the tax levied on the income generated from various investment vehicles such as stocks, bonds, mutual funds, and real estate. This tax is imposed by the government on the returns earned by individuals or entities from their investment activities.

The purpose of income tax on investments is to generate revenue for the government and to ensure that investors contribute their fair share towards public services and infrastructure. By taxing investment income, the government is able to fund various programs and initiatives that benefit society as a whole.

Common Types of Investments Subject to Income Tax

- Stocks: When investors receive dividends from owning stocks, they are subject to income tax.

- Bonds: Interest earned from bonds is taxable at both the federal and state levels.

- Mutual Funds: Capital gains distributions and dividends from mutual funds are typically taxed as ordinary income.

- Real Estate: Rental income from real estate properties is subject to income tax, along with any capital gains realized from property sales.

Taxable vs. Non-Taxable Investments

When it comes to income tax on investments, it’s important to understand the difference between taxable and non-taxable investments. Taxable investments are subject to income tax, while non-taxable investments are not taxed at the federal level.

Taxable Investments

Taxable investments include interest earned from savings accounts, dividends from stocks, and capital gains from selling assets like real estate or stocks. The income generated from these investments is taxed at the investor’s ordinary income tax rate.

- Interest from savings accounts

- Dividends from stocks

- Capital gains from selling assets

Income from taxable investments is added to your total income for the year and taxed accordingly.

Non-Taxable Investments

Non-taxable investments, on the other hand, are not subject to federal income tax. Examples of non-taxable investments include municipal bonds and contributions to a Roth IRA. The income generated from these investments is typically exempt from federal income tax.

- Municipal bonds

- Roth IRA contributions

Income from non-taxable investments may still be subject to state or local taxes, so it’s essential to understand the specific tax implications based on your location.

Tax Rates and Calculation Methods

Investors need to understand how income tax rates are determined for their investments in order to plan effectively. The tax rates can vary based on the type of investment and the investor’s overall tax situation.

Tax Rates for Different Types of Investments

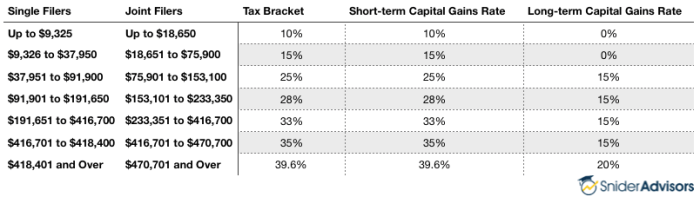

- For short-term capital gains (investments held for one year or less), the tax rate is typically the same as your ordinary income tax rate.

- Long-term capital gains (investments held for more than one year) are taxed at a lower rate, usually ranging from 0% to 20% depending on your income level.

- Interest income from bonds or savings accounts is taxed at your ordinary income tax rate.

It’s important to note that tax rates can change based on legislation and individual circumstances, so consulting with a tax professional is recommended.

Deductions and Credits

When it comes to income tax on investments, deductions and credits play a crucial role in reducing taxable income and ultimately impacting the overall tax liability for investors.

Common Deductions and Credits

- One common deduction for investors is the deduction for investment interest expenses. This allows investors to deduct the interest paid on loans used to purchase taxable investments.

- Another deduction is for investment losses. Investors can offset capital gains with capital losses, reducing their taxable income.

- Investors may also be eligible for the Foreign Tax Credit if they paid taxes on investment income in a foreign country.

Impact on Tax Liability

- Deductions and credits directly reduce the taxable income of investors, leading to a lower tax liability at the end of the year.

- By taking advantage of these deductions and credits, investors can potentially save a significant amount of money on their taxes.

Examples of Deductions and Credits

- For example, if an investor incurred $5,000 in investment interest expenses throughout the year, they can deduct this amount from their taxable income, reducing their tax liability.

- If an investor experienced $10,000 in capital losses from selling investments, they can offset this against their capital gains to lower their taxable income.

- Additionally, if an investor paid $1,000 in foreign taxes on investment income, they can claim the Foreign Tax Credit to reduce their U.S. tax liability.

Reporting Requirements

Investors are required to accurately report their investment income to comply with tax laws. Failure to do so can result in penalties and consequences from the IRS.

Types of Investment Income to Report

- Interest income from savings accounts, CDs, bonds

- Dividend income from stocks

- Capital gains from selling investments

- Rental income from real estate investments

- Any other income earned from investments

Forms to Use for Reporting

- Form 1099-INT for interest income

- Form 1099-DIV for dividend income

- Form 1099-B for capital gains

- Schedule E for rental income

Consequences of Failing to Report Investment Income

Failure to report investment income accurately can lead to penalties, fines, and even legal action by the IRS. It is important for investors to keep detailed records of their investment income and report it correctly to avoid these consequences.