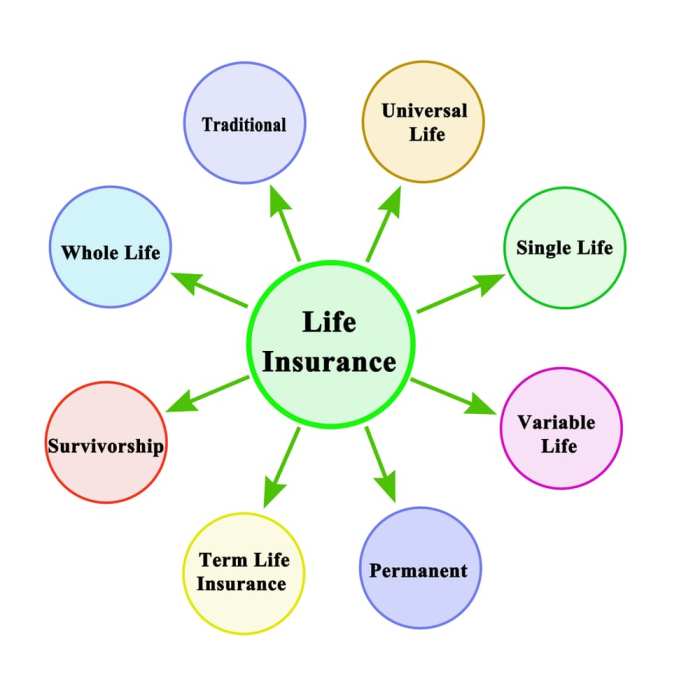

Get ready to dive into the world of Types of life insurance – we’re about to break down everything you need to know in a way that’s fresh and engaging. From term life insurance to variable life insurance, we’ve got you covered with all the details you need to make informed decisions.

Let’s kick things off with a closer look at the different types of life insurance policies and what sets them apart.

Types of Life Insurance

Life insurance is like that safety net that’s got your back when life throws you a curveball. There are different types of life insurance out there, each with its own set of features and benefits. Let’s break it down for you.

Term Life Insurance

Term life insurance is like renting a safety net for a specific period of time. You pay premiums for a set number of years, and if you pass away during that term, your beneficiaries get a payout. It’s more straightforward and usually more affordable compared to other types of life insurance.

Whole Life Insurance

Whole life insurance is like owning that safety net forever. It covers you for your entire life as long as you keep paying premiums. It also has a cash value component that grows over time, providing a savings element along with the death benefit.

Universal Life Insurance vs. Variable Life Insurance

Universal life insurance is like that flexible safety net that allows you to adjust your premiums and death benefits. It also offers a cash value component with a minimum interest rate.

On the other hand, variable life insurance is like investing in your safety net. It allows you to invest in sub-accounts like stocks and bonds, potentially increasing your cash value. However, it also comes with more risk since the cash value can fluctuate based on market performance.

And there you have it, the lowdown on different types of life insurance. It’s all about finding the right fit for your needs and budget. Stay informed, stay protected!

Term Life Insurance

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It offers a death benefit to beneficiaries if the insured passes away during the term of the policy.

Term life insurance is beneficial for individuals looking for affordable coverage with a specific timeframe in mind. It is suitable for young families, individuals with high debts, or those with financial dependents who want to ensure their loved ones are protected in case of their untimely death.

Benefits of Term Life Insurance

- Cost-effective premiums compared to whole life insurance.

- Flexible coverage options to match specific needs and budget.

- Provides financial security for a set period, such as until children are grown or debts are paid off.

Situations where Term Life Insurance is Suitable

- Young families with children who need financial protection until they are independent.

- Individuals with high mortgages or other significant debts that need coverage until debts are paid off.

- Business owners looking for key person insurance to protect the company in case of a key employee’s death.

Duration Options for Term Life Insurance Policies

- 10-year term: Offers coverage for a decade, ideal for short-term financial obligations.

- 20-year term: Provides coverage for a longer period, suitable for families with young children or long-term financial commitments.

- 30-year term: Offers the longest coverage duration, often chosen by individuals looking for coverage until retirement or to protect their family for an extended period.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. In addition to the death benefit paid out to beneficiaries upon the death of the insured, whole life insurance also has an investment component that allows the policy to accumulate cash value over time.

Investment Component of Whole Life Insurance

Whole life insurance works as an investment because a portion of the premium paid by the policyholder goes towards building cash value within the policy. This cash value grows over time on a tax-deferred basis, meaning that the policyholder does not have to pay taxes on the growth of the cash value as long as it remains within the policy.

- Policyholders can access the cash value component of their whole life insurance policy through policy loans, withdrawals, or by surrendering the policy.

- The cash value can be used for various purposes such as supplementing retirement income, funding a child’s education, or covering unexpected expenses.

Differences between Traditional Whole Life Insurance and Universal Life Insurance

Traditional whole life insurance and universal life insurance are both types of permanent life insurance, but they have some key differences:

- Traditional whole life insurance offers a guaranteed death benefit, fixed premiums, and a guaranteed cash value growth rate, providing more stability and predictability.

- Universal life insurance offers more flexibility in terms of premium payments and death benefits, allowing policyholders to adjust their coverage and premiums based on their changing needs.

- Universal life insurance also typically offers a higher potential for cash value growth through investment options linked to the policy’s cash value.

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers more flexibility compared to other policies. It provides both a death benefit and a savings component that can accumulate cash value over time.

Flexibility of Universal Life Insurance

Universal life insurance policies allow policyholders to adjust their death benefits and premiums according to their changing needs. This flexibility makes it a popular choice for individuals who want more control over their coverage.

- Policyholders can increase or decrease their death benefit as needed, providing the ability to adapt to major life events such as marriage, the birth of a child, or changes in income.

- Adjustable premiums allow policyholders to vary the amount and frequency of premium payments, making it easier to manage financial obligations while maintaining coverage.

- The cash value component of universal life insurance policies can be used to cover premiums, take out loans, or supplement retirement income.

Scenarios Where Universal Life Insurance is a Good Choice

Universal life insurance may be a suitable option for individuals who are looking for long-term coverage with the flexibility to adjust their policy as needed. Some scenarios where universal life insurance can be beneficial include:

- Young professionals who anticipate changes in income and want the ability to adjust their premiums accordingly.

- Individuals with complex financial situations who require a customizable life insurance policy to meet their specific needs.

- Business owners who want a policy that can provide both protection for their family and potential tax advantages for their business.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that has an investment component. Unlike traditional whole life insurance, the cash value of a variable life insurance policy is invested in sub-accounts, similar to mutual funds. This means that the policyholder has the opportunity to earn returns based on the performance of these investments.

Investment Component of Variable Life Insurance

Variable life insurance policies allow policyholders to allocate their cash value among a variety of investment options, such as stocks, bonds, and money market funds. The policyholder bears the investment risk, as the cash value fluctuates based on the performance of the chosen investments. The policyholder has the potential to accumulate more cash value over time if the investments perform well.

Risks Associated with Variable Life Insurance Policies

One of the main risks associated with variable life insurance is the volatility of the investment market. If the chosen investments perform poorly, the cash value of the policy can decrease, potentially affecting the death benefit and the ability to maintain the policy. Additionally, policyholders may be subject to fees and charges associated with managing the investments within the policy.

Fluctuation of Cash Value in Variable Life Insurance

The cash value in a variable life insurance policy can fluctuate based on the performance of the underlying investments. If the investments perform well, the cash value can increase, leading to a higher potential death benefit and cash value accumulation. Conversely, if the investments perform poorly, the cash value can decrease, impacting the overall value of the policy.