Get ready to dive into the world of retirement savings plans, where financial savvy meets future planning. From 401(k) to Roth IRAs, this guide will break down the essentials in a way that’s both informative and fun.

Whether you’re a high school student dreaming of the future or a seasoned adult looking to secure your retirement, this guide has something for everyone.

Types of Retirement Savings Plans

When it comes to saving for retirement, there are several types of retirement savings plans to consider. Each plan has its own unique features, eligibility criteria, and pros and cons. Let’s break down the most common types of retirement savings plans available:

401(k) Plan

A 401(k) plan is an employer-sponsored retirement savings plan that allows employees to contribute a portion of their pre-tax income to a retirement account. Employers may also match a percentage of the employee’s contributions.

- Features:

Pre-tax contributions, employer matching contributions, investment options

- Eligibility Criteria:

Usually offered to full-time employees, may have a waiting period before enrollment

- Pros:

Pre-tax contributions reduce taxable income, employer matching contributions, potential for tax-deferred growth

- Cons:

Early withdrawal penalties, limited investment options, required minimum distributions at age 72

IRA (Individual Retirement Account)

An IRA is a retirement savings account that individuals can open independently. Contributions to a Traditional IRA may be tax-deductible, while Roth IRA contributions are made with after-tax dollars.

- Features:

Tax-deductible contributions (Traditional IRA), tax-free withdrawals in retirement (Roth IRA), investment flexibility

- Eligibility Criteria:

Must have earned income, age limits for Traditional IRA contributions, income limits for Roth IRA contributions

- Pros:

Tax advantages, investment flexibility, no required minimum distributions for Roth IRA

- Cons:

Income limits for Roth IRA contributions, early withdrawal penalties, contribution limits

Pension Plan

A pension plan is a retirement plan that is funded by an employer, providing employees with a set monthly income during retirement based on years of service and salary history.

- Features:

Guaranteed income in retirement, employer-funded, may include cost-of-living adjustments

- Eligibility Criteria:

Usually offered to full-time employees, may require a certain number of years of service to be fully vested

- Pros:

Guaranteed income, employer-funded, potential for cost-of-living adjustments

- Cons:

No control over investment decisions, limited portability if changing jobs, potential for employer financial instability

Benefits of Retirement Savings Plans

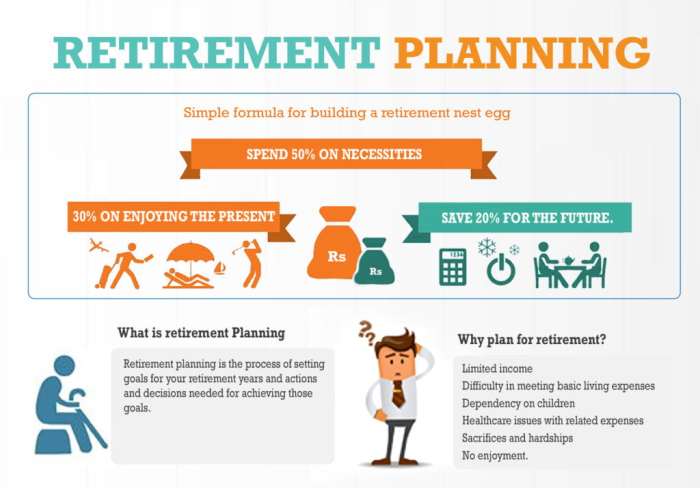

Saving for retirement is crucial, and starting a retirement savings plan early can make a significant difference in the long run. By contributing to a retirement savings plan consistently over time, individuals have the opportunity to build a substantial nest egg for their golden years.

Employer matching contributions are another key benefit of retirement savings plans. Many employers offer to match a portion of their employees’ contributions to a retirement plan, effectively doubling the savings without any extra effort. This can significantly boost retirement savings and accelerate the growth of the fund.

Contributing to retirement savings plans also comes with tax advantages. Depending on the type of plan, contributions may be tax-deductible, which can lower taxable income in the current year. Additionally, the funds in the retirement account can grow tax-deferred or even tax-free, allowing for more significant growth over time.

There are various investment options available within retirement savings plans, such as stocks, bonds, mutual funds, and target-date funds. These investment options provide individuals with the flexibility to choose a mix of assets based on their risk tolerance, time horizon, and retirement goals. Diversifying investments within the retirement account can help mitigate risk and maximize returns over the long term.

How to Calculate Retirement Savings Needs

To ensure a comfortable retirement, it’s crucial to calculate your retirement savings needs accurately. Factors such as your current age, desired retirement age, life expectancy, and annual expenses in retirement play a significant role in determining how much you need to save.

Factors to Consider when Calculating Retirement Savings Needs

- Current Age: The younger you are, the more time you have to save and benefit from compound interest.

- Desired Retirement Age: Determine at what age you want to retire, as this will impact the number of years you need to fund.

- Life Expectancy: Consider your family history and overall health to estimate how long you may live in retirement.

- Annual Expenses in Retirement: Calculate your expected annual expenses post-retirement, including housing, healthcare, food, and leisure activities.

Step-by-Step Guide on How to Calculate Retirement Savings Needs

- Estimate your annual expenses in retirement.

- Calculate the number of years you expect to be in retirement.

- Consider inflation and adjust your expenses accordingly.

- Factor in any additional sources of retirement income, such as Social Security or pensions.

- Use a retirement calculator or consult a financial advisor to determine your retirement savings target.

Retirement Savings Target and Determining It

A retirement savings target is the amount of money you need to save by the time you retire to maintain your desired lifestyle throughout retirement.

Real-Life Scenarios with Different Retirement Savings Needs Calculations

Let’s consider two scenarios:

- Scenario 1: John, aged 30, wants to retire at 65 with annual expenses of $50,000. Considering inflation and life expectancy, his retirement savings target is around $1.5 million.

- Scenario 2: Sarah, aged 45, plans to retire at 70 with annual expenses of $60,000. Her retirement savings target, factoring in inflation and life expectancy, is approximately $1.8 million.

Strategies for Maximizing Retirement Savings

Regular contributions to retirement savings plans are crucial for building a substantial nest egg for your golden years. By consistently setting aside a portion of your income, you can take advantage of compounding interest and ensure a more financially secure future.

Increasing Retirement Savings Contributions Over Time

- Start small and gradually increase your contributions as your income grows.

- Take advantage of employer matching contributions to maximize your savings potential.

- Automate your contributions to ensure consistency and avoid the temptation to spend the money elsewhere.

Diversification Within a Retirement Savings Portfolio

Diversifying your retirement savings portfolio is essential for reducing risk and maximizing returns. By spreading your investments across different asset classes such as stocks, bonds, and real estate, you can minimize the impact of market fluctuations on your savings.

Combatting the Impact of Inflation on Retirement Savings

- Consider investing in inflation-protected securities such as Treasury Inflation-Protected Securities (TIPS) to safeguard your savings against rising prices.

- Regularly review and adjust your retirement savings plan to account for inflation and ensure that your savings keep pace with the cost of living.

- Focus on long-term growth investments that have the potential to outpace inflation and preserve the purchasing power of your savings.