Diving deep into the realm of market cycles, this intro sets the stage for a rollercoaster ride through the ups and downs of financial trends. Get ready to unlock the secrets behind market fluctuations and how they shape the world of investments.

Overview of Market Cycles

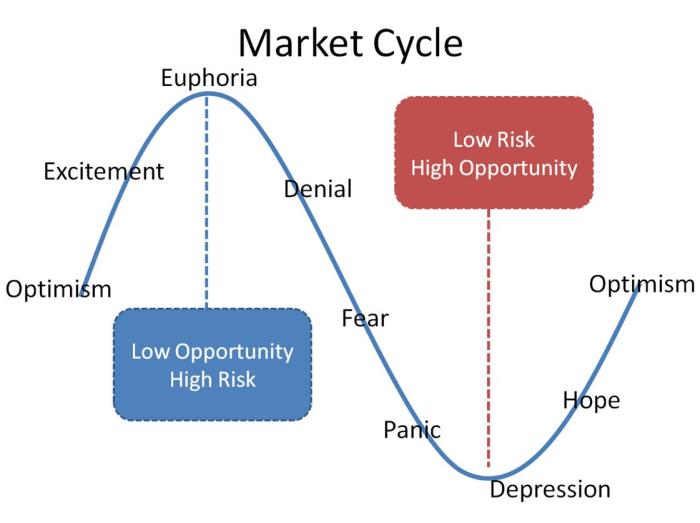

Market cycles are patterns of upward and downward movements in the financial markets. Understanding these cycles is crucial for investors and traders to make informed decisions and manage risks effectively. Market cycles consist of four main phases: expansion, peak, contraction, and trough.

During the expansion phase, economic activity and market prices are on the rise. This is typically a period of growth and optimism in the markets. As the market reaches its peak, prices start to stabilize, and investor confidence remains high. The contraction phase follows, characterized by a decline in economic activity and market prices. Finally, the trough marks the lowest point in the cycle, with prices bottoming out before the cycle begins again.

Historical market cycles have had a significant impact on various industries. For example, the dot-com bubble of the late 1990s and early 2000s was a period of rapid expansion followed by a sharp contraction, leading to the collapse of many tech companies. On the other hand, the housing market crash of 2008 resulted in a prolonged period of economic downturn, affecting industries such as banking, real estate, and construction.

Examples of Historical Market Cycles

- The Great Depression in the 1930s: The stock market crash of 1929 led to a prolonged period of economic contraction, impacting industries across the board.

- The Roaring Twenties: A period of economic prosperity and cultural growth in the 1920s, followed by the Great Depression.

- The Tech Bubble Burst: The collapse of many internet companies in the early 2000s after a period of rapid expansion in the tech sector.

Factors Influencing Market Cycles

The market cycles are influenced by various factors that play a crucial role in determining the direction of the economy. These factors can range from economic indicators to geopolitical events and even investor sentiment and psychology.

Key Economic Indicators

Economic indicators such as GDP, interest rates, and inflation have a significant impact on market cycles. For instance, a strong GDP growth rate can indicate a healthy economy, leading to bullish market cycles. Conversely, high inflation rates may trigger a bearish market cycle as investors anticipate a decrease in purchasing power.

- High interest rates can dampen consumer spending and business investments, leading to a slowdown in economic growth and potentially triggering a recession.

- Low interest rates, on the other hand, can stimulate borrowing and spending, boosting economic activity and driving market cycles towards an upswing.

Geopolitical Events

Geopolitical events, such as trade wars, political instability, or global conflicts, can have a profound impact on market cycles. These events can create uncertainty and volatility in the markets, causing investors to react based on their perceptions of the potential risks involved.

- A trade war between major economies can disrupt supply chains, increase tariffs, and lead to market corrections as companies adjust to the new trade environment.

- Political instability in key regions can create uncertainty among investors, causing them to pull back from riskier assets and move towards safer investments.

Investor Sentiment and Psychology

Investor sentiment and psychology play a crucial role in influencing market cycles. The collective behavior of investors, driven by emotions such as fear and greed, can lead to market booms and busts.

- During periods of optimism, investors may exhibit irrational exuberance, driving asset prices to unsustainable levels and creating asset bubbles that eventually burst.

- In times of pessimism, investors may panic and sell off their holdings, leading to market downturns and prolonged bearish cycles.

Strategies for Navigating Market Cycles

Navigating market cycles requires a deep understanding of the different phases and the ability to adjust investment strategies accordingly. By tailoring your approach to each phase, you can maximize returns and minimize risks.

Investment Strategies Tailored to Different Phases

- During the early expansion phase, consider investing in growth stocks or sectors that stand to benefit from economic growth.

- As the market peaks, it may be wise to start reallocating towards defensive sectors like utilities or consumer staples.

- In the contraction phase, focus on preserving capital by investing in safe-haven assets like bonds or gold.

- During the trough, look for opportunities to buy undervalued assets that have the potential for long-term growth.

Managing Risk During Different Market Cycles

- During the expansion phase, be cautious of excessive risk-taking and maintain a diversified portfolio to mitigate potential losses.

- As the market approaches a peak, consider reducing exposure to high-risk assets and increasing allocations to more stable investments.

- In the contraction phase, focus on capital preservation by avoiding highly leveraged positions and maintaining a cash buffer.

- During the trough, be selective in taking risks and look for opportunities with strong fundamentals and growth potential.

Diversification to Mitigate Risks

Diversification is a key strategy for navigating market cycles as it helps spread risk across different assets and sectors. By holding a mix of investments with low correlation, you can reduce the impact of any individual market downturn on your overall portfolio. This approach can help you weather volatility and uncertainty while maintaining a more stable investment profile.

Case Studies on Market Cycles

In this section, we will delve into specific examples of companies or sectors that have experienced success or challenges during different market cycles. We will also explore how market cycles impact various asset classes such as stocks, bonds, and commodities, providing valuable insights for future investment decisions.

Tech Sector Boom and Bust

The late 1990s witnessed a massive boom in the technology sector, with companies like Microsoft and Cisco leading the way. Investors were pouring money into tech stocks, driving up valuations to unprecedented levels. However, this bubble burst in the early 2000s, resulting in the infamous dot-com crash. Many companies went bankrupt, and investors suffered significant losses. This case study highlights the importance of recognizing market euphoria and being cautious of unsustainable valuations.

Housing Market Crash of 2008

The 2008 financial crisis was triggered by the bursting of the housing bubble in the United States. Banks were heavily exposed to subprime mortgages, which led to a collapse in the housing market. Companies like Lehman Brothers faced bankruptcy, and the stock market experienced a sharp decline. This case study underscores the interconnectedness of different asset classes and the domino effect that can occur during a market downturn.

Commodities Super Cycle

From the early 2000s to the mid-2010s, commodities experienced a super cycle characterized by soaring prices driven by strong demand from emerging markets like China. Companies involved in mining and energy extraction reaped huge profits during this period. However, the cycle eventually turned, leading to a sharp decline in commodity prices. This case study emphasizes the cyclical nature of commodity markets and the importance of diversification in a portfolio.