Get ready to dive into the world of FICO scores, where numbers hold the key to your financial future. From decoding the complexities to unraveling the significance, this journey promises to be a rollercoaster of insights and revelations.

Let’s break down the components of FICO scores, explore their calculation methods, and understand why they wield such power in the realm of finance.

What are FICO scores?

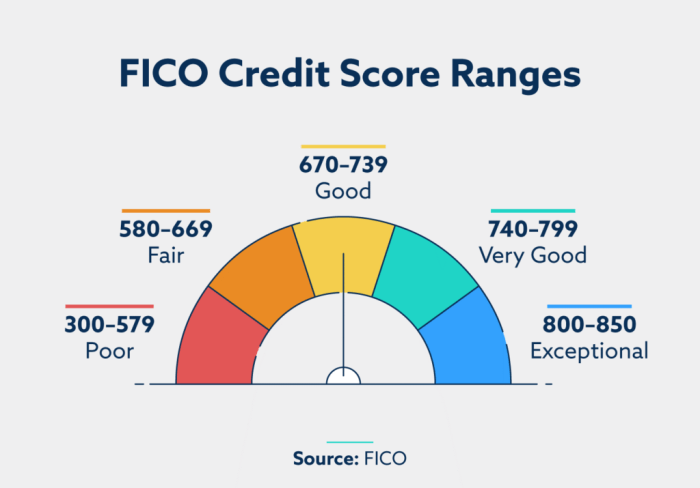

FICO scores are numerical representations of an individual’s creditworthiness, indicating how likely they are to repay borrowed money. These scores are generated based on credit reports from major credit bureaus like Equifax, Experian, and TransUnion.

Importance of FICO scores

FICO scores play a crucial role in financial decision-making for both individuals and lenders. A higher FICO score generally indicates a lower credit risk for lenders, making it easier to qualify for loans, credit cards, or favorable interest rates. On the other hand, a lower FICO score may lead to higher interest rates or difficulty in obtaining credit.

Examples of how FICO scores are used by lenders

- Lenders use FICO scores to determine the interest rates offered to borrowers. Individuals with higher scores may qualify for lower interest rates, saving them money over time.

- When applying for a mortgage, a higher FICO score can result in a lower down payment requirement, making homeownership more accessible.

- Credit card companies often use FICO scores to set credit limits and determine eligibility for certain rewards programs or perks.

How are FICO scores calculated?

When it comes to calculating FICO scores, several key factors come into play. These factors influence the overall credit score and determine an individual’s creditworthiness. Understanding these components is essential for managing and improving your FICO score.

Factors that influence FICO scores

- Payment History: This is the most significant factor in calculating FICO scores. It reflects whether you have paid your bills on time and in full. Late payments can have a negative impact on your score.

- Credit Utilization: This refers to the amount of credit you are currently using compared to your total available credit. Keeping this ratio low can positively affect your score.

- Length of Credit History: The longer your credit history, the better it is for your FICO score. It shows how experienced you are with managing credit responsibly.

- New Credit: Opening multiple new credit accounts within a short period can lower your score as it may indicate financial stress or increased risk.

- Credit Mix: Having a mix of different types of credit, such as credit cards, loans, and mortgages, can positively impact your FICO score.

Step-by-step breakdown of how FICO scores are calculated

- Payment History (35%): The most critical factor, reflecting whether payments are made on time.

- Amounts Owed (30%): Includes credit utilization and the total amount owed on all accounts.

- Length of Credit History (15%): How long your accounts have been open and the time since the last activity.

- New Credit (10%): Considers the number of new accounts and credit inquiries.

- Credit Mix (10%): Looks at the variety of credit accounts you have, including credit cards, loans, and mortgages.

Why is it important to understand FICO scores?

Understanding FICO scores is crucial because they play a significant role in various financial aspects of our lives. Your FICO score can impact your ability to secure loans, determine the interest rates you receive, affect insurance premiums, and even influence rental applications.

Impact of FICO scores on loan approvals and interest rates

Having a good FICO score can make a huge difference when applying for loans. Lenders use your FICO score to assess your creditworthiness and determine the risk of lending you money. A higher score can lead to faster approvals and more favorable interest rates, saving you money in the long run.

How FICO scores can affect insurance premiums and rental applications

Insurance companies often consider your FICO score when calculating premiums. A lower score may result in higher premiums, as it is seen as an indicator of financial risk. Similarly, landlords may request your FICO score when applying for a rental property. A good score can make you a more attractive tenant, while a poor score may lead to rejection or require a higher security deposit.

Tips on how to improve FICO scores

- Pay your bills on time: Late payments can significantly impact your FICO score.

- Keep your credit card balances low: High credit card balances relative to your credit limit can negatively affect your score.

- Avoid opening multiple new accounts at once: Too many new accounts can lower your average account age and reduce your score.

- Regularly check your credit report: Look for errors or fraudulent activity that could harm your score.

- Be patient and consistent: Improving your FICO score takes time and discipline, so stay committed to healthy financial habits.

How do different credit bureaus impact FICO scores?

When it comes to FICO scores, the three major credit bureaus – Equifax, Experian, and TransUnion – play a significant role in determining an individual’s creditworthiness. Each bureau collects and maintains credit information on consumers, which can impact their FICO scores.

Comparison of FICO scores from Equifax, Experian, and TransUnion

- Equifax, Experian, and TransUnion all use the FICO scoring model to calculate credit scores, but the information they have may vary slightly due to differences in the data reported to each bureau.

- Equifax and TransUnion use a scoring range of 300 to 850, while Experian uses a range of 330 to 830.

- Each bureau may have different accounts, inquiries, or errors on file, leading to discrepancies in credit reports and ultimately affecting FICO scores differently.

Discrepancies in credit reports and their impact on FICO scores

- Discrepancies in credit reports, such as inaccuracies, outdated information, or fraudulent activity, can lead to differences in credit scores across the three bureaus.

- Errors in credit reports can negatively impact FICO scores, as lenders rely on this information to make decisions about extending credit.

- It’s crucial to regularly monitor credit reports from all three bureaus to identify and dispute any errors that could be dragging down your FICO score.

Monitoring and disputing errors in credit reports

- Consumers can request free credit reports from Equifax, Experian, and TransUnion once a year through AnnualCreditReport.com to keep track of their credit information.

- If discrepancies are found, individuals should follow the dispute process Artikeld by each credit bureau to correct errors and ensure their credit reports are accurate.

- By staying vigilant and taking action to rectify inaccuracies, consumers can maintain healthy credit reports and improve their FICO scores over time.