Ready to dive into the world of financial planning for retirement? Buckle up as we explore the ins and outs of securing your financial future in style.

From understanding the importance of early planning to exploring different retirement savings vehicles, this guide has got you covered.

Importance of Financial Planning for Retirement

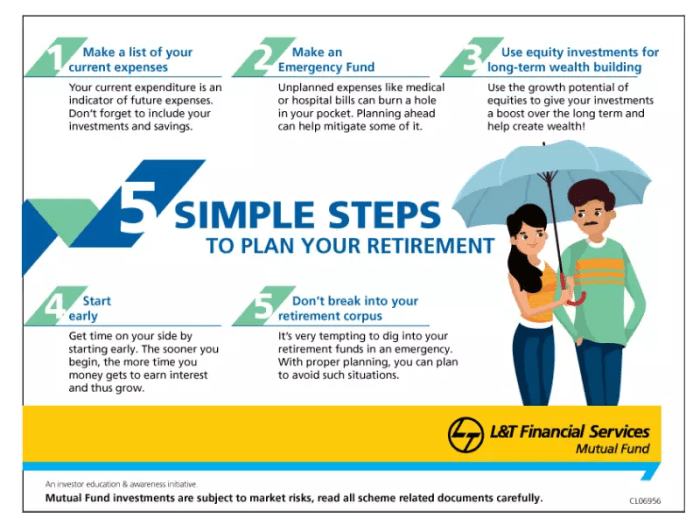

Financial planning for retirement is crucial for ensuring a secure and comfortable future. It involves setting goals, creating a budget, and investing wisely to build a nest egg that will support you during your retirement years.

Key Benefits of Having a Solid Retirement Plan

- Financial Security: A solid retirement plan provides financial security and peace of mind, knowing that you have enough savings to cover your expenses during retirement.

- Independence: With a well-thought-out retirement plan, you can maintain your independence and not have to rely on others for financial support in your later years.

- Flexibility: Having a retirement plan in place gives you the flexibility to make choices about how you want to spend your time and resources once you retire.

How Early Financial Planning Can Impact Retirement Savings

Starting to plan for retirement early can have a significant impact on the amount of savings you accumulate over time. By saving and investing consistently from a young age, you can take advantage of compounding interest and grow your retirement fund exponentially.

Components of a Comprehensive Retirement Plan

When it comes to creating a comprehensive retirement plan, there are several key components that should be included to ensure a secure financial future. These essential elements encompass a range of strategies and considerations that are crucial for successful retirement planning.

Role of Investments, Savings, and Budgeting

Investments, savings, and budgeting play integral roles in the construction of a solid retirement plan. Here’s a breakdown of their significance:

- Investments: Allocating funds into various investment vehicles such as stocks, bonds, mutual funds, and real estate can help grow your retirement nest egg over time. Diversifying your investment portfolio is essential to mitigate risks and maximize returns.

- Savings: Setting aside a portion of your income regularly into a retirement savings account, such as a 401(k) or IRA, is vital for building a financial cushion for your retirement years. Consistent saving habits can lead to substantial wealth accumulation over the long term.

- Budgeting: Developing a realistic budget that Artikels your income, expenses, and savings goals is crucial for effective retirement planning. By tracking your spending habits and making necessary adjustments, you can ensure that you are living within your means and saving adequately for retirement.

Strategies for Managing Debt

Debt management is a significant aspect of retirement planning that should not be overlooked. Here are some strategies to help you address and manage debt effectively:

- Pay off High-Interest Debt: Prioritize paying off high-interest debts, such as credit card balances, as they can eat into your retirement savings. By reducing your debt burden, you can free up more funds for saving and investing.

- Consolidate and Refinance: Consider consolidating multiple debts into a single loan with a lower interest rate or refinancing existing loans to secure more favorable terms. This can help lower your monthly payments and make debt repayment more manageable.

- Develop a Repayment Plan: Create a structured repayment plan that Artikels how you will tackle your debts over time. Set specific goals and timelines for paying off each debt, and make consistent payments to chip away at your outstanding balances.

Retirement Savings Vehicles

When it comes to saving for retirement, there are various options to consider. Let’s compare and contrast different retirement savings vehicles like 401(k), IRA, and Roth IRA to help you make informed decisions.

401(k)

- A 401(k) is an employer-sponsored retirement account where you can contribute a portion of your pre-tax income.

- Benefits:

- Employer matching contributions

- Tax-deferred growth of savings

- Limitations:

- Early withdrawal penalties

- Required minimum distributions after a certain age

IRA (Individual Retirement Account)

- An IRA is a retirement account that you set up on your own, allowing you to contribute a certain amount annually.

- Benefits:

- Flexibility in investment choices

- Potential tax deductions on contributions

- Limitations:

- Income limits for tax deductions

- Early withdrawal penalties

Roth IRA

- A Roth IRA is similar to a traditional IRA but with after-tax contributions, allowing for tax-free withdrawals in retirement.

- Benefits:

- Tax-free withdrawals in retirement

- No required minimum distributions

- Limitations:

- No upfront tax deductions on contributions

- Income limits for contributions

By diversifying your retirement savings across different vehicles like 401(k), IRA, and Roth IRA, you can reduce risk and maximize your savings potential for a comfortable retirement. It’s essential to understand the benefits and limitations of each option to create a comprehensive retirement plan tailored to your financial goals. Start saving early and make informed decisions to secure your financial future.

Social Security and Retirement Planning

Social Security plays a crucial role in retirement planning for many individuals in the United States. It provides a steady source of income during retirement years, supplementing personal savings and investments.

Factors to Consider When Deciding the Optimal Age to Start Receiving Social Security Benefits

When deciding the optimal age to start receiving Social Security benefits, individuals should consider factors such as their life expectancy, financial needs, health status, employment status, and marital status. It’s important to weigh the trade-offs between starting benefits early at a reduced rate or delaying benefits for a higher payout.

How Social Security Benefits Can Supplement Retirement Savings

Social Security benefits can supplement retirement savings by providing a guaranteed source of income that is adjusted for inflation. This can help reduce the risk of outliving savings and provide a foundation for a comfortable retirement lifestyle. It’s essential to maximize Social Security benefits by understanding claiming strategies and coordinating benefits with other sources of retirement income.

Estate Planning and Retirement

Estate planning is a crucial aspect of retirement planning that often gets overlooked. It involves making decisions about how your assets will be distributed after you pass away. Integrating estate planning into your retirement plan can help ensure that your hard-earned assets are protected and passed on to your loved ones according to your wishes.

Importance of Estate Planning in Retirement

Estate planning is important in retirement because it allows you to control what happens to your assets when you are no longer around. Without a proper estate plan, your assets may be subject to probate, which can be a lengthy and costly legal process. By creating an estate plan, you can designate beneficiaries, minimize estate taxes, and ensure that your assets are distributed according to your wishes.

Protecting Assets for Future Generations

Estate planning can help protect your assets for future generations by establishing trusts, setting up life insurance policies, and creating a will or a living trust. These tools can help minimize estate taxes, avoid probate, and ensure that your assets are passed down to your heirs in a smooth and efficient manner.

Integrating Estate Planning into Retirement Plan

To integrate estate planning into your overall retirement plan, you should first take stock of all your assets and liabilities. Next, consult with an estate planning attorney to create a will, establish trusts, and designate beneficiaries. It’s important to review and update your estate plan regularly, especially after major life events such as marriage, divorce, or the birth of children.