Diving into the world of asset allocation strategies, we uncover the key principles and techniques that drive successful investment management. From traditional methods to modern approaches, the landscape of asset allocation is vast and ever-evolving. Get ready to explore how strategic and tactical asset allocation can shape your financial future.

In this guide, we’ll break down the concept of asset allocation, delve into different asset classes, and emphasize the crucial role it plays in balancing risk and return in your investment portfolio.

Asset Allocation Strategies

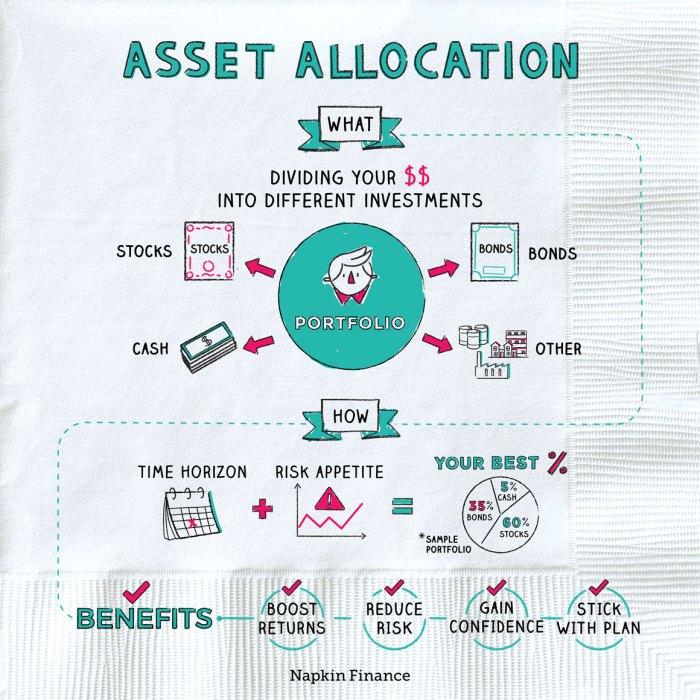

Asset allocation is a crucial concept in investment that involves spreading your money across different asset classes to achieve a balance between risk and return.

Types of Asset Classes

There are several types of asset classes that can be included in a portfolio:

- Equities: Stocks represent ownership in a company and offer the potential for high returns but come with higher risk.

- Bonds: These are debt securities issued by governments or corporations, providing a steady income stream with lower risk compared to stocks.

- Real Estate: Investing in physical properties can offer diversification and potential appreciation in value.

- Commodities: These include raw materials like gold, oil, and agricultural products, which can act as a hedge against inflation.

Importance of Asset Allocation

Asset allocation plays a crucial role in managing risk and return in an investment portfolio. By diversifying across different asset classes, investors can reduce the impact of market volatility on their overall returns. It helps in spreading risk and ensuring that a single market downturn does not severely impact the entire portfolio. Additionally, asset allocation allows investors to tailor their portfolios to their risk tolerance and investment goals, balancing the potential for higher returns with the level of risk they are willing to take.

Traditional vs. Modern Asset Allocation

When it comes to asset allocation strategies, there is a clear distinction between traditional methods and modern approaches. Let’s delve into the differences and evolution of these techniques.

Evolution of Asset Allocation Strategies

Asset allocation has come a long way from the traditional methods of simply dividing funds between stocks and bonds. Modern approaches take into account a more diversified range of asset classes, such as real estate, commodities, and alternative investments.

Impact of Technology and Data Analytics

Technology and data analytics have revolutionized modern asset allocation techniques. With the advent of AI and machine learning algorithms, investors can now analyze vast amounts of data to make informed decisions in real-time. This has led to more efficient and precise allocation of assets, ultimately maximizing returns and minimizing risks.

Strategic Asset Allocation

Strategic asset allocation is a long-term investment strategy that involves setting target allocations for various asset classes in a portfolio based on an investor’s risk tolerance, time horizon, and financial goals. The goal is to create a diversified mix of assets that can help achieve the desired level of return while managing risk effectively over time.

Developing a Strategic Asset Allocation Plan

Strategic asset allocation plan should consider the following guidelines:

- Assess your risk tolerance: Determine how much risk you are willing to take on in your investment portfolio. This will help you decide on the right mix of assets.

- Define your investment goals: Clearly Artikel your financial objectives, whether it’s saving for retirement, buying a house, or funding your children’s education.

- Understand your time horizon: Consider how long you have until you need to access your investments. Longer time horizons generally allow for more aggressive asset allocations.

- Diversify your assets: Spread your investments across different asset classes, such as stocks, bonds, real estate, and cash equivalents, to reduce risk.

- Regularly review and rebalance: Monitor your portfolio periodically and make adjustments to maintain your target asset allocation mix.

Benefits of Sticking to a Strategic Asset Allocation Strategy

Sticking to a strategic asset allocation strategy despite market fluctuations can offer several benefits, including:

- Discipline and consistency: By following a predetermined plan, investors can avoid making emotional decisions during market volatility.

- Risk management: Diversification across asset classes can help reduce the impact of downturns in any single investment.

- Potential for long-term growth: A well-balanced portfolio can capture growth opportunities in various market conditions while mitigating losses.

- Peace of mind: Having a clear strategy in place can provide investors with peace of mind and confidence in their long-term financial plan.

Tactical Asset Allocation

Tactical asset allocation involves making short-term adjustments to a portfolio based on market conditions and opportunities, unlike strategic asset allocation which focuses on long-term goals and maintaining a predetermined asset mix.

Examples of Tactical Asset Allocation Techniques

- Market Timing: Investors may adjust their allocation based on economic indicators, market trends, or geopolitical events.

- Sector Rotation: Shifting investments between sectors based on the expected performance of different industries.

- Risk Management: Adjusting asset allocation to reduce risk during volatile market conditions.

Challenges of Implementing a Successful Tactical Asset Allocation Strategy

- Market Timing Risks: Making accurate predictions consistently is challenging and can result in missed opportunities or losses.

- Overtrading: Frequent adjustments can lead to higher transaction costs and potential tax implications.

- Emotional Decision Making: Reacting to short-term market movements can be influenced by emotions rather than a rational investment strategy.