With how to calculate ROI at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

Understanding ROI is crucial for businesses to make informed decisions and assess the success of their investments. In this guide, we will dive deep into the world of ROI calculation, exploring its significance, components, and practical steps to calculate it accurately.

Understanding ROI Calculation

When it comes to making business decisions, understanding Return on Investment (ROI) is crucial. ROI is a financial metric used to evaluate the profitability of an investment relative to its cost.

Definition of ROI

ROI is a ratio that compares the net profit of an investment to its initial cost. It is expressed as a percentage and provides insight into the efficiency and profitability of an investment.

- ROI = (Net Profit / Cost of Investment) x 100%

Importance of ROI in Business

Calculating ROI helps businesses assess the success of their investments and make informed decisions about future ventures. It allows companies to prioritize projects with the highest potential for returns and allocate resources effectively.

By calculating ROI, businesses can determine which investments are generating the most value and optimize their strategies accordingly.

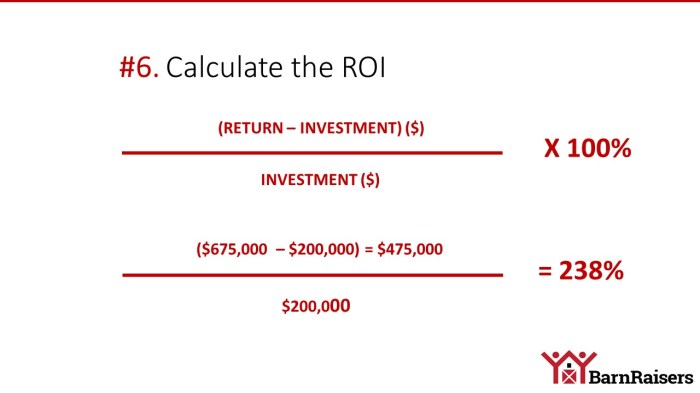

Formula for Calculating ROI

To calculate ROI, you need to subtract the initial cost of the investment from the final value and divide the result by the initial cost. The formula is as follows:

- ROI = (Final Value of Investment – Initial Cost of Investment) / Initial Cost of Investment

Components of ROI Calculation

To calculate ROI, there are key components that need to be considered. Understanding these components is crucial in determining the return on investment and making informed business decisions.

Investment Cost

One of the main components of ROI calculation is the initial investment cost. This includes all expenses incurred to acquire an asset, start a project, or implement a strategy. It is essential to accurately track and document all costs associated with the investment.

Revenue Generated

The revenue generated from the investment is another critical component in calculating ROI. This includes all income, sales, or earnings generated as a result of the investment. Determining the revenue accurately is important to calculate the return on investment effectively.

Time Frame

The time frame over which the return on investment is calculated is an important component. It is essential to specify the period during which the return is measured, whether it is monthly, quarterly, or annually. The time frame helps in analyzing the effectiveness of the investment over a specific period.

ROI Formula

ROI = (Net Profit / Investment Cost) x 100

Example of Investment

Investments can vary and may include purchasing new equipment, launching a marketing campaign, or acquiring a new business. These are all examples of investments that can be evaluated using ROI calculations to determine their profitability and success.

Calculating ROI

Calculating ROI is essential for determining the success of an investment. It helps businesses evaluate the efficiency of their financial decisions and strategize for future growth. Here is a step-by-step guide on how to calculate ROI effectively.

Step 1: Determine Net Profit

To calculate ROI, you first need to determine the net profit generated from the investment. This can be calculated by subtracting the initial investment cost from the total revenue or income generated.

Step 2: Calculate Cost of Investment

Next, calculate the total cost of the investment, including expenses such as marketing costs, operational expenses, and any other costs associated with the investment.

Step 3: Divide Net Profit by Cost of Investment

Once you have the net profit and total cost of investment, divide the net profit by the cost of investment. This will give you the ROI percentage.

Step 4: Multiply by 100

To express the ROI as a percentage, multiply the result from step 3 by 100. This will give you the ROI percentage, which can be used to compare different investments.

Significance of Calculating ROI

Calculating ROI is crucial for businesses to make informed decisions about their investments. It helps in evaluating the profitability of projects, determining which investments are worth pursuing, and identifying areas for improvement in financial strategies.

Interpreting ROI Results

When it comes to interpreting ROI results, it’s crucial to understand what the numbers are telling you. ROI is a measure of the profitability of an investment relative to its cost, so the higher the ROI, the more profitable the investment. On the other hand, a negative ROI indicates that the investment has not been profitable.

Different ROI Values

- An ROI of 0% means that the investment has not generated any return.

- An ROI between 0% and 100% indicates that the investment has generated a profit, with higher values representing higher profitability.

- An ROI greater than 100% signifies that the investment has more than doubled its initial cost, resulting in significant profitability.

- A negative ROI suggests that the investment has resulted in a loss, with lower values indicating higher losses.

Analyzing and Decision Making

It is essential to analyze ROI results in the context of your specific goals and financial situation. Consider factors such as the time frame of the investment, associated risks, and opportunity costs.

- High ROI values may indicate successful investments that should be continued or expanded.

- Low or negative ROI values may signal the need to reevaluate the investment strategy or consider alternative options.

- Comparing ROI values across different investments can help prioritize where to allocate resources for maximum profitability.