As retirement fund allocation takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Let’s dive into the realm of retirement fund allocation and explore the ins and outs of ensuring a secure financial future.

Importance of Retirement Fund Allocation

Properly allocating funds for retirement is crucial in ensuring financial stability and security during your golden years. By strategically distributing your savings into various investment vehicles, you can maximize growth potential and mitigate risks.

Impact of Proper Allocation

- Investing in a diverse portfolio can help spread risk and potentially increase returns over time.

- Allocating funds based on your risk tolerance and timeline can optimize your retirement savings growth.

- Regularly reviewing and adjusting your allocations as needed can adapt to changing market conditions and financial goals.

Risks of Improper Allocation

- Putting all your retirement savings in one high-risk investment can lead to significant losses if the market takes a downturn.

- Ignoring diversification and allocating too conservatively may not yield sufficient returns to sustain your desired lifestyle in retirement.

- Failing to rebalance your portfolio periodically can result in an unbalanced allocation that does not align with your financial objectives.

Types of Retirement Accounts

When it comes to saving for retirement, there are several types of retirement accounts you can choose from. Each type has its own features, benefits, and tax implications, so it’s important to understand the differences before deciding where to allocate your funds.

Traditional IRA

- Contributions are typically tax-deductible, reducing your taxable income for the year.

- Earnings grow tax-deferred until withdrawal during retirement.

- Withdrawals in retirement are taxed as ordinary income.

Roth IRA

- Contributions are made with after-tax dollars, so they are not tax-deductible.

- Earnings grow tax-free, and qualified withdrawals in retirement are also tax-free.

- No required minimum distributions (RMDs) during the account holder’s lifetime.

401(k)

- Employer-sponsored retirement account where contributions are made with pre-tax dollars, reducing taxable income.

- Some employers match a portion of employee contributions, providing free money towards retirement.

- Earnings grow tax-deferred until withdrawal, which is taxed as ordinary income in retirement.

403(b)

- Similar to a 401(k) but typically offered to employees of non-profit organizations, schools, and certain government entities.

- Contributions are made with pre-tax dollars, and earnings grow tax-deferred.

- Withdrawals in retirement are taxed as ordinary income.

SEP IRA

- Designed for self-employed individuals or small business owners.

- Contributions are tax-deductible and earnings grow tax-deferred.

- Withdrawals in retirement are taxed as ordinary income.

Factors to Consider in Allocation

When it comes to allocating funds for retirement, there are several key factors that individuals need to consider. These factors play a crucial role in determining the optimal allocation strategy to ensure a secure and comfortable retirement.

Age and Risk Tolerance

As individuals progress through different stages of life, their risk tolerance and investment goals tend to change. Younger individuals with a longer time horizon before retirement can typically afford to take on more risk in their investment portfolio. This is because they have more time to recover from any market downturns. On the other hand, as individuals approach retirement age, they may want to shift towards more conservative investments to protect their nest egg from potential market volatility.

Diversification

Diversification is a key principle in retirement fund allocation. By spreading investments across different asset classes such as stocks, bonds, and real estate, individuals can reduce the overall risk in their portfolio. Diversification helps to mitigate the impact of market fluctuations in any one asset class and can potentially enhance overall returns over the long term.

Strategies for Effective Fund Allocation

When it comes to allocating your retirement funds, having a solid strategy in place is crucial for securing your financial future. By implementing popular strategies and creating a personalized plan, you can ensure that your funds are working for you effectively.

Target-Date Funds

Target-date funds are a popular choice for many investors looking for a hands-off approach to retirement fund allocation. These funds automatically adjust the asset allocation based on your target retirement date, becoming more conservative as you approach retirement.

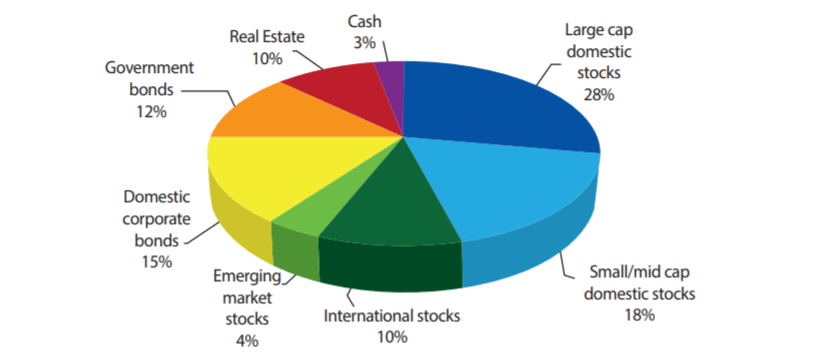

Asset Allocation Models

Asset allocation models involve diversifying your retirement portfolio across different asset classes such as stocks, bonds, and cash equivalents. This strategy aims to optimize returns while managing risk based on your risk tolerance and timeline to retirement.

Creating a Personalized Fund Allocation Strategy

- Evaluate Your Risk Tolerance: Determine how much risk you are willing to take on based on your age, financial goals, and comfort level.

- Consider Your Time Horizon: Take into account how many years you have until retirement and adjust your asset allocation accordingly.

- Diversify Your Portfolio: Spread your investments across various asset classes to minimize risk and maximize returns.

- Periodic Review and Adjustments: Regularly review your fund allocation strategy and make adjustments as needed based on market conditions and changes in your financial situation.

Importance of Periodic Review and Adjustments

It’s essential to periodically review and adjust your fund allocation strategy to ensure that it remains aligned with your financial goals and risk tolerance. By staying proactive and making changes when necessary, you can adapt to market fluctuations and optimize your retirement savings for the long term.