Diving into the world of tax planning tips, get ready to uncover strategies that can help you keep more of your hard-earned money. From understanding the importance of tax planning to exploring efficient investment options, this guide will equip you with the knowledge to navigate the complex world of taxes with ease.

Whether you’re an individual looking to save on taxes or a small business aiming to optimize your financial management, these tips will provide valuable insights to help you plan ahead.

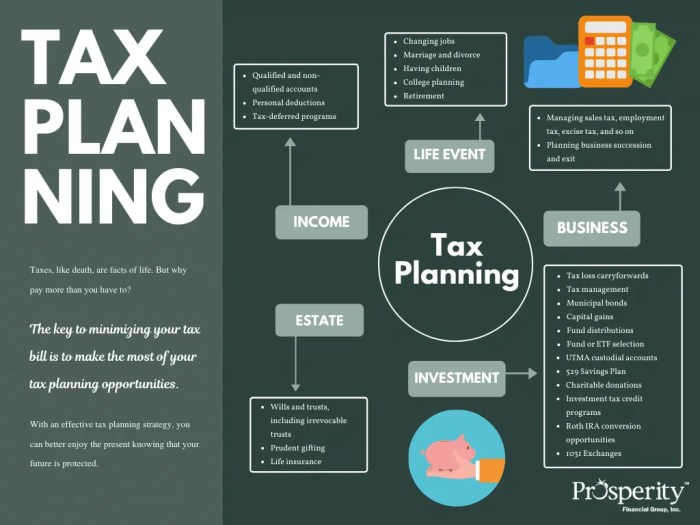

Importance of Tax Planning

Tax planning is like the secret sauce of financial management, helping individuals and businesses navigate the complex world of taxes like a boss. By strategizing ahead of time, you can maximize your savings and keep more of your hard-earned money in your pocket.

Benefits of Tax Planning

- Reduce Tax Liability: With effective tax planning, you can legally minimize the amount of taxes you owe, ensuring you don’t pay a penny more than necessary.

- Maximize Deductions: By taking advantage of all available deductions and credits, you can lower your taxable income and potentially receive a larger tax refund.

- Improve Cash Flow: Planning your taxes can help you manage your finances better, ensuring you have enough cash on hand to cover your expenses and invest in your future.

How Tax Planning Saves Money

- Strategic Investments: Through tax planning, you can make smart investment decisions that not only grow your wealth but also come with tax benefits, such as capital gains tax reductions.

- Retirement Planning: By setting up tax-efficient retirement accounts and making contributions strategically, you can secure your financial future while enjoying tax advantages along the way.

- Legal Compliance: Staying on top of tax laws and regulations through planning helps you avoid costly penalties and audits, keeping your finances in good shape.

Tax Planning Strategies

When it comes to tax planning, there are various strategies that individuals and small businesses can use to minimize their tax liabilities and maximize their savings. By understanding these strategies and implementing them effectively, taxpayers can ensure they are not paying more taxes than necessary. Let’s dive into some common tax planning strategies and techniques for small businesses, as well as the differences between short-term and long-term tax planning.

Common Tax Planning Strategies for Individuals

- Take advantage of tax-deferred accounts such as 401(k) or IRA to save for retirement while reducing taxable income.

- Claim all eligible deductions and credits, such as mortgage interest, medical expenses, and charitable contributions.

- Consider tax-loss harvesting to offset capital gains with capital losses in investment portfolios.

- Plan for health care expenses by contributing to Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs).

- Optimize timing of income and expenses to lower tax brackets in certain years.

Tax Planning Techniques for Small Businesses

- Choose the right business structure, such as an S Corporation or LLC, to minimize self-employment taxes.

- Keep accurate records and track all expenses to claim deductions for business-related costs.

- Consider accelerated depreciation methods to deduct the cost of business assets over a shorter period.

- Take advantage of tax credits for hiring employees from certain groups or investing in renewable energy.

- Explore retirement plans for small business owners, like SEP-IRAs or SIMPLE IRAs, to save for retirement and reduce taxable income.

Short-term vs. Long-term Tax Planning Strategies

- Short-term tax planning focuses on immediate tax savings through deductions, credits, and deferrals for the current tax year.

- Long-term tax planning involves strategic decisions that can impact taxes over several years, such as estate planning, retirement savings, and investment strategies.

- Short-term strategies are often reactive and based on annual tax filings, while long-term strategies require proactive planning and consideration of future financial goals.

- Combining short-term and long-term tax planning strategies can provide a comprehensive approach to managing taxes efficiently and maximizing savings over time.

Tax-Efficient Investment Options

Investing in tax-efficient options can help minimize tax liabilities and maximize returns on investments. By strategically selecting investment vehicles, individuals can reduce the impact of taxes on their investment gains.

Municipal Bonds

Municipal bonds are debt securities issued by state and local governments to fund public projects. The interest income generated from municipal bonds is typically exempt from federal taxes and may also be exempt from state and local taxes if the investor resides in the same state as the issuing municipality. This makes municipal bonds a tax-efficient investment option for individuals in higher tax brackets.

401(k) and IRA Accounts

Contributing to retirement accounts such as a 401(k) or an Individual Retirement Account (IRA) can provide tax benefits. These accounts allow individuals to defer taxes on their contributions until retirement, potentially lowering their current tax liabilities. Additionally, earnings within these accounts grow tax-deferred until withdrawals are made in retirement.

Index Funds and ETFs

Index funds and Exchange-Traded Funds (ETFs) are passively managed investment vehicles that track the performance of a specific market index. These funds typically have lower turnover rates compared to actively managed funds, resulting in fewer capital gains distributions. This can reduce the tax consequences for investors, making index funds and ETFs tax-efficient investment options.

Tax-Loss Harvesting

Tax-loss harvesting involves strategically selling investments at a loss to offset capital gains and reduce taxes owed. By realizing losses, investors can minimize their tax liabilities while maintaining a diversified portfolio. This technique can be a valuable tax planning strategy to optimize investment returns.

Tax Credits and Deductions

When it comes to tax planning, understanding tax credits and deductions is crucial. These two components can significantly impact your tax liabilities, helping you save money and maximize your refunds.

Key Tax Credits and Deductions

- One of the key tax credits available to individuals is the Earned Income Tax Credit (EITC), which is designed to help low to moderate-income taxpayers.

- Another important tax credit is the Child Tax Credit, which provides a credit for each qualifying child under the age of 17.

- Common deductions include the standard deduction and itemized deductions such as mortgage interest, state and local taxes, and charitable contributions.

Maximizing Tax Credits and Deductions

Maximizing tax credits and deductions can significantly reduce your tax liabilities and increase your tax refund. By taking advantage of all available credits and deductions, you can lower your taxable income and potentially move into a lower tax bracket.

Retirement Planning and Taxes

When it comes to retirement planning, taxes play a crucial role in determining how much of your hard-earned money you get to keep in your pocket. Understanding the tax implications of your retirement accounts and knowing how to minimize taxes during retirement can significantly impact your financial security in your golden years.

Impact of Retirement Planning on Taxes

- Contributions to traditional retirement accounts, such as a 401(k) or Traditional IRA, are typically tax-deductible, reducing your taxable income for the year.

- Withdrawals from these accounts in retirement are taxed as ordinary income, which means you’ll pay taxes on the money you withdraw based on your tax bracket at that time.

- Roth retirement accounts, on the other hand, are funded with after-tax dollars, so withdrawals in retirement are usually tax-free, providing a tax-efficient income stream.

Tips to Minimize Taxes During Retirement

- Consider a Roth conversion to move money from a traditional retirement account to a Roth account, paying taxes now to potentially avoid higher taxes in the future.

- Plan your withdrawals strategically to stay within lower tax brackets and avoid triggering higher taxes on your Social Security benefits.

- Utilize tax-efficient investment strategies to minimize capital gains taxes on your investment income during retirement.

Tax Implications of Different Retirement Account Options

- Traditional IRA and 401(k) contributions are tax-deductible, but withdrawals are taxed as ordinary income.

- Roth IRA contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement.

- Health Savings Accounts (HSAs) offer triple tax benefits – contributions are tax-deductible, growth is tax-deferred, and withdrawals for qualified medical expenses are tax-free.