Yo, diving into stock portfolio analysis, get ready to ride the waves of investment knowledge. We’re about to break down the ins and outs of analyzing those stocks like a pro.

So, let’s get into the nitty-gritty of why stock portfolio analysis is a game-changer for investors and how it can help you make those money moves.

Importance of Stock Portfolio Analysis

When it comes to investing in the stock market, analyzing your portfolio is key, ya know what I’m sayin’? It ain’t just about throwing money at random stocks and hoping for the best, you gotta stay on top of your game and know what’s up with your investments.

Regular portfolio analysis ain’t just for fun, it’s like checking your grades before finals week – you gotta know where you stand, what’s working, and what ain’t. By keeping tabs on your portfolio, you can make adjustments as needed and maximize your gains, ya dig?

Benefits of Regular Portfolio Analysis

- Helps track the performance of your investments over time, allowing you to see what’s poppin’ and what’s floppin’.

- Allows you to rebalance your portfolio to maintain your desired level of risk and return, keeping things in check.

- Gives you insights into your investment strategy, helping you learn from past decisions and make smarter moves in the future.

How Portfolio Analysis Helps in Making Informed Investment Decisions

- By analyzing your portfolio, you can identify trends and patterns that can guide your future investment choices, like having a crystal ball, but for stocks.

- Helps you understand the correlation between different assets in your portfolio, so you can diversify like a pro and reduce risk.

- Provides you with the data and insights needed to make educated decisions, rather than relying on luck or gut feelings.

Types of Stock Portfolio Analysis

When it comes to analyzing a stock portfolio, there are various methods that investors can use to evaluate their investments. Each method provides a unique perspective on the performance and potential of the portfolio. Let’s dive into some of the key types of stock portfolio analysis.

Fundamental Analysis

Fundamental analysis is a method of evaluating a stock by analyzing financial statements, economic indicators, and other factors that can affect a company’s performance. This type of analysis focuses on the intrinsic value of a stock and helps investors determine whether a stock is undervalued or overvalued. By examining factors such as revenue, earnings, and debt levels, fundamental analysis provides insights into the long-term prospects of a stock.

Technical Analysis

Technical analysis, on the other hand, focuses on historical price movements and trading volume to predict future price movements. This method involves using charts and technical indicators to identify patterns and trends in stock prices. Technical analysts believe that past price movements can help predict future price movements, allowing investors to make informed decisions about buying or selling stocks based on chart patterns and market trends.

Quantitative Analysis

Quantitative analysis involves using mathematical models and statistical techniques to evaluate the performance of a stock portfolio. This method relies on quantitative data such as historical returns, risk measures, and correlations between assets to assess the risk and return characteristics of a portfolio. By analyzing data and applying statistical models, investors can optimize their portfolios and make strategic investment decisions based on quantitative insights.

In conclusion, each type of stock portfolio analysis offers a unique perspective on evaluating investments. Fundamental analysis provides insights into the intrinsic value of a stock, while technical analysis focuses on price trends and patterns. Quantitative analysis, on the other hand, utilizes mathematical models to assess portfolio performance. By combining these methods, investors can gain a comprehensive understanding of their stock portfolios and make informed decisions to maximize returns and manage risk effectively.

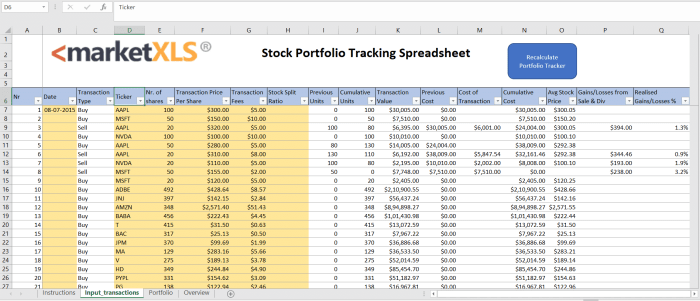

Tools for Stock Portfolio Analysis

When it comes to analyzing your stock portfolio, having the right tools can make a world of difference. Utilizing software and platforms designed for portfolio analysis can help you make informed decisions and maximize your investment potential.

Financial Modeling Software

Financial modeling software like Excel or Google Sheets can be incredibly useful for analyzing your stock portfolio. These tools allow you to create detailed financial models, perform complex calculations, and visualize your data in a clear and concise manner.

Online Portfolio Trackers

Online portfolio trackers such as Yahoo Finance, Morningstar, or Personal Capital can provide real-time updates on your investments, track performance, and offer insights into your portfolio diversification. These platforms often offer customizable features and alerts to help you stay on top of your investments.

Comparison of Portfolio Analysis Tools

- Spreadsheets: Ideal for creating custom models and performing in-depth analysis.

- Financial Modeling Software: Offers advanced capabilities for complex calculations and scenario analysis.

- Online Portfolio Trackers: Provides real-time updates, performance tracking, and portfolio diversification insights.

Key Metrics and Ratios in Portfolio Analysis

When evaluating a stock portfolio, it is crucial to consider various key metrics and ratios that provide valuable insights into its performance and risk profile. These metrics help investors make informed decisions and optimize their investment strategies.

Significance of Metrics like Sharpe Ratio, Beta, and Standard Deviation

- The Sharpe ratio measures the risk-adjusted return of a portfolio by comparing the excess return to the standard deviation of returns. A higher Sharpe ratio indicates better risk-adjusted performance.

- Beta measures the sensitivity of a stock or portfolio to overall market movements. A beta of 1 indicates that the stock moves in line with the market, while a beta greater than 1 signifies higher volatility.

- Standard deviation quantifies the volatility or risk associated with the returns of a stock or portfolio. A higher standard deviation implies greater price fluctuations and higher risk.

Calculation and Interpretation of Common Ratios like P/E Ratio, P/B Ratio, and Dividend Yield

- The P/E ratio (Price-to-Earnings ratio) compares a stock’s current price to its earnings per share. A high P/E ratio may indicate an overvalued stock, while a low P/E ratio could signal undervaluation.

- The P/B ratio (Price-to-Book ratio) compares a stock’s market price to its book value per share. A P/B ratio below 1 may indicate an undervalued stock.

- Dividend yield measures the annual dividend income relative to the stock price. A higher dividend yield signifies a higher return on investment through dividends.

Role of Risk-Adjusted Return Measures in Assessing Portfolio Performance

- Risk-adjusted return measures like the Sharpe ratio and Treynor ratio help investors evaluate how well a portfolio has performed relative to the level of risk taken.

- These measures allow investors to compare different portfolios or investment strategies on a risk-adjusted basis, enabling them to make more informed decisions.

Strategies for Effective Portfolio Analysis

When it comes to analyzing your stock portfolio, implementing effective strategies is key to maximizing returns and minimizing risks.

Diversifying Your Stock Portfolio

Diversification is crucial in minimizing risk in your stock portfolio. By spreading your investments across different asset classes, industries, and geographic regions, you can reduce the impact of volatility in any single investment.

- Invest in a mix of stocks, bonds, and other assets to spread risk.

- Consider investing in different industries to avoid sector-specific risks.

- Explore international investments to diversify geographically.

Importance of Asset Allocation and Rebalancing

Asset allocation involves determining the right mix of assets based on your investment goals, risk tolerance, and time horizon. Regularly rebalancing your portfolio ensures that your asset allocation stays in line with your target allocation.

- Review your portfolio regularly to ensure it aligns with your investment strategy.

- Rebalance your portfolio periodically to maintain desired asset allocation.

- Adjust your asset allocation as your investment goals or risk tolerance change.

Using Sector Analysis and Market Trends

Monitoring sector performance and market trends can help you optimize your stock portfolio by identifying opportunities and risks in specific industries.

- Conduct sector analysis to identify sectors with growth potential.

- Stay informed about market trends to make informed investment decisions.

- Adjust your portfolio allocation based on sector performance and market outlook.