Diving deep into Financial metrics for startups, get ready to explore the vital role these numbers play in the success of budding businesses. From tracking key financial metrics to making informed decisions, this is where the magic happens.

As we journey further, we’ll uncover the different types of financial metrics, delve into the world of Key Performance Indicators (KPIs), and understand the significance of financial reporting and analysis. Strap in for a finance-filled ride like never before!

Importance of Financial Metrics for Startups

Financial metrics are crucial for startups as they provide valuable insights into the financial health of the business, helping founders and stakeholders make informed decisions. By tracking key financial metrics, startups can identify areas of strength and weakness, monitor progress towards financial goals, and optimize resource allocation for sustainable growth.

Key Financial Metrics for Startups

- Cash Burn Rate: The rate at which a startup is spending its cash reserves, indicating how long the business can operate before running out of funds.

- Customer Acquisition Cost (CAC): The cost incurred to acquire a new customer, essential for evaluating the effectiveness of marketing and sales strategies.

- Lifetime Value (LTV): The projected revenue that a customer will generate over the entire relationship with the business, helping startups understand the long-term value of customers.

- Runway: The amount of time a startup has before it runs out of cash, calculated based on the current burn rate and available cash reserves.

Benefits of Tracking Financial Metrics

- Decision-Making: By monitoring financial metrics, startups can make data-driven decisions to allocate resources effectively and prioritize initiatives that drive growth.

- Performance Evaluation: Tracking key metrics allows startups to evaluate their financial performance, identify trends, and make adjustments to improve profitability.

- Investor Confidence: Demonstrating a solid grasp of financial metrics can instill confidence in investors and stakeholders, showcasing the startup’s financial stability and growth potential.

Types of Financial Metrics

Financial metrics for startups can be divided into different categories that help assess the company’s performance and financial health. These categories include profitability, liquidity, and efficiency. Each type of financial metric serves a specific purpose and provides valuable insights for startup businesses.

Profitability Metrics

Profitability metrics measure a company’s ability to generate profits relative to its revenue, assets, or equity. Examples of profitability metrics include:

- Gross Profit Margin: Calculated by subtracting the cost of goods sold from revenue and dividing by revenue. It indicates how efficiently a company is producing goods or services.

- Net Profit Margin: Calculated by subtracting all expenses, including taxes and interest, from revenue and dividing by revenue. It shows how much profit a company is making from its operations.

- Return on Investment (ROI): Measures the return generated on an investment relative to the cost of the investment.

Liquidity Metrics

Liquidity metrics evaluate a company’s ability to meet its short-term financial obligations. Examples of liquidity metrics include:

- Current Ratio: Calculated by dividing current assets by current liabilities. It indicates a company’s ability to cover its short-term liabilities with its short-term assets.

- Quick Ratio: Similar to the current ratio but excludes inventory from current assets. It provides a more conservative measure of liquidity.

- Working Capital: Calculated by subtracting current liabilities from current assets. It shows how much capital a company has available to fund its daily operations.

Efficiency Metrics

Efficiency metrics assess how well a company utilizes its resources to generate revenue. Examples of efficiency metrics include:

- Inventory Turnover: Measures how many times a company sells and replaces its inventory in a given period. A higher turnover indicates efficient inventory management.

- Accounts Receivable Turnover: Measures how quickly a company collects payments from customers. A higher turnover indicates effective credit and collection policies.

- Asset Turnover: Compares a company’s revenue to its total assets to determine how efficiently assets are used to generate sales.

Key Performance Indicators (KPIs) for Startups

Key Performance Indicators, or KPIs, are essential metrics that startups use to measure their progress towards achieving specific business objectives. These indicators provide valuable insights into the health and performance of the startup, helping entrepreneurs make informed decisions to drive growth and success.

Common KPIs for Startups

- Cash Burn Rate: This KPI measures how quickly a startup is spending its available cash. It helps in determining the runway, or the time until the startup runs out of money.

- Customer Acquisition Cost (CAC): CAC helps in understanding how much it costs to acquire a new customer. Keeping this metric low is crucial for sustainable growth.

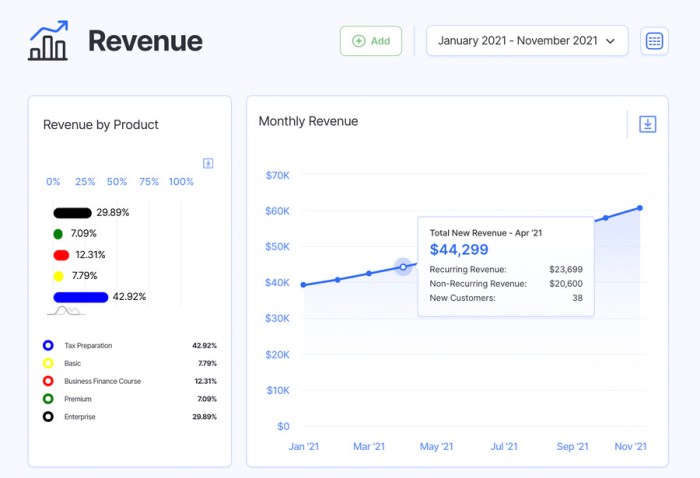

- Monthly Recurring Revenue (MRR): MRR indicates the predictable revenue that a startup expects on a monthly basis. It is a key metric for subscription-based businesses.

- Churn Rate: Churn rate measures the percentage of customers who stop using a product or service over a specific period. It is crucial for evaluating customer retention.

Significance of KPIs for Startups

KPIs play a vital role in helping startups set achievable goals, track progress, and make data-driven decisions. By monitoring these key metrics, startups can identify areas for improvement, optimize strategies, and stay focused on what matters most for their growth and success.

Financial Reporting and Analysis

Financial reporting for startups involves compiling and presenting financial information in a standardized format to stakeholders, including investors, creditors, and management. This process typically includes preparing financial statements such as income statements, balance sheets, and cash flow statements.

Importance of Analyzing Financial Data

Analyzing financial data is crucial for startups as it provides insights into the financial health of the business. By examining financial reports, startups can identify trends, assess performance, and make informed decisions to improve profitability and sustainability.

- Identifying Areas of Improvement: Analyzing financial data helps startups pinpoint areas where they can cut costs, increase revenue, or optimize resources.

- Forecasting Future Performance: By analyzing historical financial data, startups can make projections and set realistic goals for the future.

- Measuring Business Performance: Financial analysis allows startups to track key performance indicators (KPIs) and evaluate the success of their business strategies.

Interpreting Financial Reports

Interpreting financial reports involves understanding the information presented and using it to make strategic decisions for the business. Here are some methods for interpreting financial reports effectively:

- Comparative Analysis: Comparing current financial data with past periods or industry benchmarks can provide valuable insights into performance and trends.

- Ratio Analysis: Calculating financial ratios such as profitability, liquidity, and efficiency ratios can help startups assess their financial health and identify areas for improvement.

- Trend Analysis: Examining financial data over time can reveal patterns and trends that can inform decision-making and strategic planning.