Yo, as we dive into the world of debt reduction strategies, get ready for a ride filled with knowledge bombs that’ll help you navigate your financial journey like a boss. From creating budgets to negotiating with creditors, we’ve got your back every step of the way.

Let’s break down the different methods and tips to help you crush that debt and secure your financial freedom.

Understanding Debt Reduction Strategies

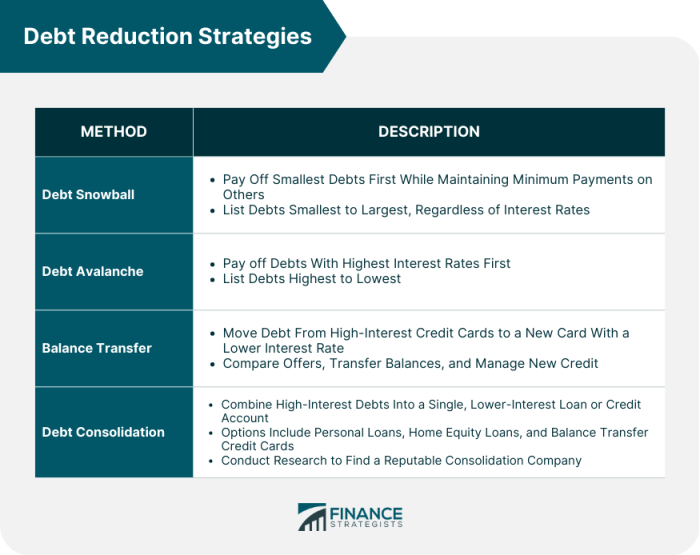

Debt reduction strategies are specific plans or methods individuals use to pay off their debts more efficiently. These strategies help in managing and reducing debt to achieve financial freedom and stability.

Importance of Having a Plan to Reduce Debt

Having a plan to reduce debt is crucial because it provides a roadmap for individuals to follow in order to tackle their debts effectively. Without a plan, it can be easy to feel overwhelmed and unsure of where to start. By having a structured approach, individuals can stay focused, motivated, and track their progress towards becoming debt-free.

Common Types of Debt Reduction Strategies

- Snowball Method: This strategy involves paying off the smallest debts first while making minimum payments on larger debts. Once the smallest debt is paid off, the individual moves on to the next smallest debt, creating a snowball effect.

- Avalanche Method: In this strategy, individuals focus on paying off debts with the highest interest rates first. By tackling high-interest debts, individuals can save money on interest over time.

- Debt Consolidation: This strategy involves combining multiple debts into a single loan with a lower interest rate. This simplifies the repayment process and may reduce the overall amount paid in interest.

- Budgeting and Cutting Expenses: By creating a budget and cutting unnecessary expenses, individuals can free up more money to put towards debt repayment.

Creating a Budget for Debt Reduction

When it comes to reducing debt, creating a budget is essential for managing your finances effectively and making progress towards becoming debt-free. A budget helps you track your income, expenses, and debt payments, allowing you to prioritize where your money goes and identify areas where you can cut back to allocate more funds towards debt repayment.

Allocating Funds Towards Debt Payments

- Start by listing all your sources of income and fixed expenses to determine how much money you have available to put towards debt payments.

- Identify non-essential expenses that you can reduce or eliminate to free up more money for debt repayment.

- Consider using the debt snowball or debt avalanche method to prioritize which debts to pay off first, based on interest rates or balances.

- Allocate a specific amount from your budget towards debt payments each month to ensure consistent progress in reducing your debt.

Role of Budgeting in Successful Debt Reduction Strategies

- Budgeting helps you stay organized and maintain control over your finances, preventing overspending and ensuring you have enough money to cover debt payments.

- By tracking your expenses and income through a budget, you can identify areas where you can save money and increase your debt repayment efforts.

- Having a budget in place allows you to set clear financial goals and monitor your progress towards reducing debt, keeping you motivated and focused on your long-term financial health.

Snowball vs. Avalanche Method

When it comes to paying off debt, two popular strategies that individuals often consider are the snowball and avalanche method. Both methods have their own unique approach to reducing debt, but they differ in how they prioritize which debts to pay off first.

Snowball Method

- The snowball method involves paying off your debts from smallest to largest, regardless of interest rate.

- Pro: Provides quick wins by paying off smaller debts first, which can boost motivation and momentum.

- Con: May result in paying more interest over time compared to the avalanche method.

Avalanche Method

- The avalanche method focuses on paying off debts with the highest interest rates first, regardless of balance size.

- Pro: Saves money on interest payments in the long run by tackling high-interest debts first.

- Con: It may take longer to see progress compared to the snowball method, which could be demotivating for some individuals.

Real-Life Examples

For example, Sarah decided to use the snowball method to pay off her credit card debt. By paying off her smaller balances first, she was able to eliminate multiple debts quickly, which kept her motivated to continue tackling her larger debts.

In contrast, John opted for the avalanche method to pay off his student loans. Although it took longer to pay off his high-interest loans, he saved a significant amount of money on interest payments in the long run.

Negotiating with Creditors

Negotiating with creditors can be a crucial step in reducing your debt burden and finding a way to manage your finances effectively. By communicating effectively and being proactive, you may be able to secure lower interest rates or settlements that work better for your financial situation.

Tips for Negotiating with Creditors

- Prepare a detailed overview of your financial situation before contacting your creditors. This will help you clearly explain your circumstances and what you can realistically afford.

- Be polite and respectful during negotiations. Creditors are more likely to work with you if you are cooperative and honest about your financial challenges.

- Clearly state your proposal for lower interest rates or settlements, and be prepared to provide reasons why these changes would benefit both parties.

- Stay persistent and patient throughout the negotiation process. It may take time to reach an agreement, but staying committed to finding a resolution can pay off in the long run.

Success Stories of Negotiating Debt

- John was able to negotiate a lower interest rate on his credit card debt by contacting his creditor directly and explaining his financial hardship. By staying calm and presenting a reasonable proposal, he was able to secure a more manageable repayment plan.

- Sarah successfully negotiated a settlement on her outstanding medical bills by reaching out to the hospital’s billing department. By providing documentation of her financial struggles and proposing a lump-sum payment, she was able to reduce her debt significantly.

Debt Consolidation

Debt consolidation is a financial strategy where multiple debts are combined into a single loan or payment. This can be done through a new loan, balance transfer credit card, or debt consolidation program.

Benefits and Drawbacks of Debt Consolidation

- Benefits:

- Streamlined Payments: Managing one payment instead of multiple can make it easier to stay organized.

- Potentially Lower Interest Rates: Consolidating debt can lead to lower overall interest costs if the new loan has a lower rate.

- Potential for Lower Monthly Payments: Extending the repayment period can result in lower monthly payments.

- Drawbacks:

- Possible Fees: Some debt consolidation options may come with fees that increase the overall cost of the loan.

- Extended Repayment Period: While monthly payments may decrease, a longer repayment period can mean more interest paid over time.

- Requires Discipline: Consolidating debt does not address the root cause of debt accumulation, so it’s essential to avoid taking on new debt.

Suitable Scenarios for Debt Consolidation

Debt consolidation may be a suitable strategy in the following scenarios:

- When juggling multiple high-interest debts becomes overwhelming and hard to manage.

- If a lower interest rate can be secured through consolidation, reducing overall interest costs.

- For individuals committed to changing spending habits and avoiding further debt accumulation.