Yo, listen up! Financial responsibility is like the key to unlocking your future success. It’s all about making smart money moves now so you can live your best life later. Get ready to dive into the world of financial responsibility and learn how it can change the game for you.

In this guide, we’ll break down why being financially responsible is crucial, how to develop those money-smart skills, and the nitty-gritty of budgeting, debt management, and savings. So, buckle up and let’s roll!

Importance of Financial Responsibility

Financial responsibility is crucial for individuals as it helps in ensuring financial stability and security. By managing money wisely and making informed financial decisions, individuals can avoid debt, save for the future, and achieve their financial goals.

Positive Impacts of Financial Responsibility

- Building a strong financial foundation: Practicing financial responsibility early on can help individuals build a solid financial foundation for the future.

- Reducing stress: Being in control of one’s finances can reduce stress and anxiety related to money issues.

- Improving credit score: Responsible financial behavior, such as paying bills on time and managing debt, can lead to a higher credit score.

Consequences of Lacking Financial Responsibility

- Accumulating debt: Without financial responsibility, individuals may find themselves in debt due to overspending and poor money management.

- Lack of savings: Not saving money for emergencies or the future can leave individuals vulnerable to financial crises.

- Impact on relationships: Financial irresponsibility can strain relationships, leading to conflicts over money matters.

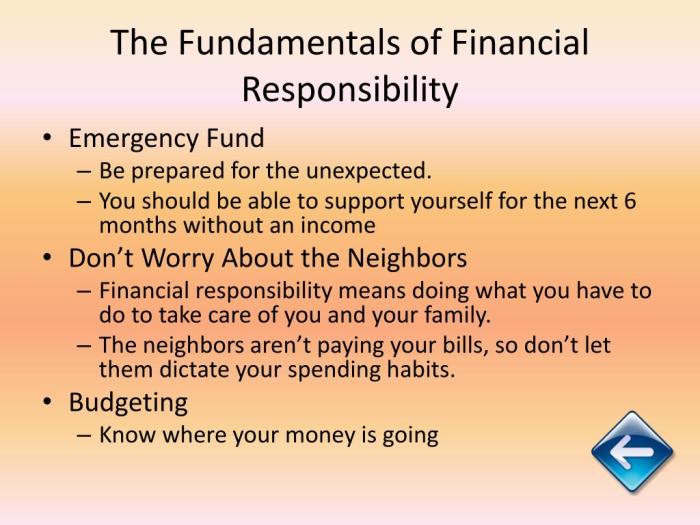

Developing Financial Responsibility

Developing financial responsibility is crucial for a secure future. It involves making smart decisions about money, saving for the future, and avoiding unnecessary debt.

Strategies for Cultivating Financial Responsibility

- Set financial goals: Establish clear objectives for saving and spending.

- Create a budget: Track income and expenses to ensure financial stability.

- Avoid impulse purchases: Think carefully before making any non-essential buys.

- Build an emergency fund: Save money for unexpected expenses.

- Invest wisely: Learn about different investment options and make informed decisions.

Short-term vs. Long-term Approaches

Short-term approaches focus on immediate financial decisions and habits, such as budgeting and saving for short-term goals. Long-term approaches involve planning for the future, investing for retirement, and building wealth over time.

Role of Education in Enhancing Financial Responsibility

Education plays a vital role in enhancing financial responsibility by providing individuals with the knowledge and skills needed to make informed financial decisions. Financial literacy programs in schools and communities can help people develop a strong foundation for managing their money effectively.

Budgeting and Financial Planning

Budgeting and financial planning are essential components of maintaining financial responsibility. By creating a budget and effectively planning your finances, you can ensure that you are able to meet your financial obligations, save for the future, and avoid falling into debt.

Significance of Budgeting

Budgeting helps you track your income and expenses, allowing you to see where your money is going and make necessary adjustments to avoid overspending. It also helps you prioritize your spending, save for emergencies, and work towards your financial goals.

Simple Budgeting Template for Beginners

- List all sources of income

- Track all expenses, categorizing them into essentials (e.g., rent, utilities) and non-essentials (e.g., dining out, entertainment)

- Set spending limits for each category based on your income

- Review your budget regularly and make adjustments as needed

Tips for Effective Financial Planning

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey

- Set specific financial goals, whether it’s saving for a vacation, buying a new car, or building an emergency fund

- Automate your savings by setting up automatic transfers to a savings account

- Avoid unnecessary debt by only using credit cards for purchases you can pay off in full each month

- Regularly review your financial situation and adjust your budget and financial plan accordingly

Debt Management and Savings

Managing debt responsibly is crucial for maintaining financial health. By reducing debt, individuals can free up more money for savings and investments, ultimately securing a better financial future. Savings, on the other hand, play a vital role in providing a financial cushion for emergencies, retirement, and achieving long-term financial goals.

Techniques for Managing and Reducing Debt Responsibly

- Start by creating a budget to track income and expenses accurately.

- Prioritize high-interest debt and focus on paying it off first.

- Consider debt consolidation to streamline payments and potentially lower interest rates.

- Avoid taking on new debt while working on paying off existing balances.

The Importance of Savings in Financial Responsibility

- Savings serve as a safety net for unexpected expenses, such as medical emergencies or car repairs.

- Having savings can prevent individuals from going into debt to cover unforeseen costs.

- Savings also provide the opportunity to invest in the future, whether for retirement, education, or major purchases.

The Relationship Between Debt Management, Savings, and Overall Financial Health

- Effective debt management frees up resources that can be redirected towards savings and investments.

- By reducing debt and increasing savings, individuals can improve their financial stability and security.

- Having a balance between debt management and savings is key to achieving long-term financial goals and building wealth over time.